Question: Show all steps to getting the answer please! 1. Assume that you were recently discharged from the US Navy after six years of active-duty service

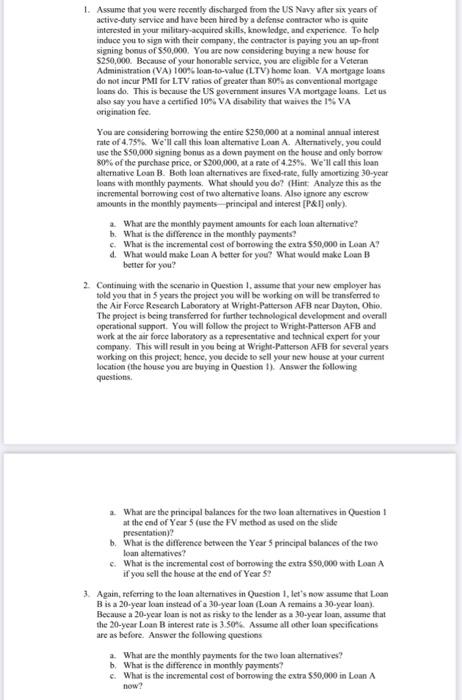

1. Assume that you were recently discharged from the US Navy after six years of active-duty service and have been hired by a defense contractor who is quite interested in your military-acquired skills, knowledge, and experience. To help induce you to sign with their company, the contractor is paying you an up-front signing bonus of $50,000. You are now considering buying a new house for $250,000. Because of your honorable service, you are eligible for a Veteran Administration (VA) 100% loan-to-value (LTV) home loan. VA mortgage loans do not incur PMI for LTV ratios of greater than 80% as conventional mortgage loans do. This is because the US government insures VA mortgage loans. Let us also say you have a certified 10% VA disability that waives the 1% VA origination fee.

You are considering borrowing the entire $250,000 at a nominal annual interest rate of 4.75%. We'll call this loan alternative Loan A. Alternatively, you could use the $50,000 signing bonus as a down payment on the house and only borrow 80% of the purchase price, or $200,000, at a rate of 4.25%. We'll call this loan alternative Loan B. Both loan alternatives are fixed-rate, fully amortizing 30-year loans with monthly payments. What should you do? (Hint: Analyze this as the incremental borrowing cost of two alternative loans. Also ignore any escrow amounts in the monthly payments principal and interest [P&I] only).

- What are the monthly payment amounts for each loan alternative?

- What is the difference in the monthly payments?

- What is the incremental cost of borrowing the extra $50,000 in Loan A?

- What would make Loan A better for you? What would make Loan B better for you?

2. Continuing with the scenario in Question 1, assume that your new employer has told you that in 5 years the project you will be working on will be transferred to the Air Force Research Laboratory at Wright-Patterson AB near Dayton, Ohio. The project is being transferred for further technological development and overall operational support. You will follow the project to Wright-Patterson AFB and work at the air force laboratory as a representative and technical expert for your company. This will result in you being at Wright-Patterson AFB for several years working on this project; hence, you decide to sell your new house at your current location (the house you are buying in Question 1). Answer the following questions.

- What are the principal balances for the two loan alternatives in Question 1 at the end of Year 5 (use the FV method as used on the slide presentation)?

- What is the difference between the Year 5 principal balances of the two loan alternatives?

- What is the incremental cost of borrowing the extra $50,000 with Loan A if you sell the house at the end of Year 5?

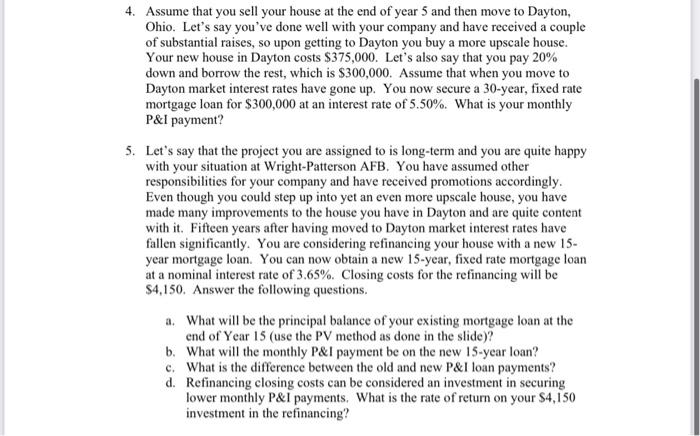

3. Again, referring to the loan alternatives in Question 1, let's now assume that Loan B is a 20-year loan instead of a 30-year loan (Loan A remains a 30-year loan). Because a 20-year loan is not as risky to the lender as a 30-year loan, assume that the 20-year Loan B interest rate is 3.50%. Assume all other loan specifications are as before. Answer the following questions

- What are the monthly payments for the two loan alternatives?

- What is the difference in monthly payments?

- What is the incremental cost of borrowing the extra $50,000 in Loan A now?

- What will be the principal balance of your existing mortgage loan at the end of Year 15 (use the PV method as done in the slide)?

- What will the monthly P&I payment be on the new 15-year loan?

- What is the difference between the old and new P&I loan payments?

- Refinancing closing costs can be considered an investment in securing lower monthly P&I payments. What is the rate of return on your $4,150 investment in the refinancing?

1. Assume that yoo were reeently discharged from the US Navy affer six years of active-duty service and have been hired by a defense contractor who is quite interested in your military-acquired skills, knowledge, and experience. To belp induce you to sign with their company, the contractor is paying you an up-front signing bonus of S50,000. You are now considering buying a new bouse for \$250,000. Because of your bothorable serviee, you are eligible for a Veteran Admiaistration (VA) 100:s loan-to-value (LTV) bome loan. VA mortgage loans do not incur PMIl for L.TV ratios of greater than 80\%s ats conventional mortgage loans do. This is because the US goverament insures VA mortgage loans. Let us also say you have a certified 10% VA desability that waives the 1% VA origination fec. You are considering bortowing the entire $250,000 at a nominal annual inierest rate of 4.75%. We'll call this loan altemative Loan A. Alternatively, you could use the $50,000 signing bonus as a down poyment on the house and only borrow 80% of the purchase price, or $200,000, at a rate of 4.25%. We'Il call this loan alhernative Loan B. Both loan alternatives are fived-rate, fully amortizing 30-year loans with monthly payments. What shoold you do? (Hint: Analyze this as the incremental borrowing post of two aliemative loans. Also ignore any escrow ameants in the mosihly payments principul and interest [P\&I] only). a. What are the monthly payment amounts for each loan alkernative? b. What is the difference in the monthly payments? c. What is the incremental cost of bortowing the extra $50,000 in Loan A? 4. What would make Loan A better for you? What would make Loan B betier for you? 2. Continaing with the scenario in Question 1, assume that your new employer has told you that in 5 years the project you will be working on will be transferred to the Air Foree Research Laboratory at Wright-Patterson AFB near Dayton, Ohio. The project is being transferred for further technological development and overall operational support. You will follow the project to Wright-Patterson AFB and work at the air force laboratory as a repecsentative and technical expert for your company. This will resull in yoe being at Wright-Patterson AFB for several years working on this project; hence, yoe decide to sell your new hotse at your current location (the bouse you are buyigg in Question 1). Answer the following questions. a. What are the principal bulances for the two loan alternatives in Qecstion I at the ead of Year 5 (use the FV method as used on the slide presentation)? b. What is the difference between the Year 5 principal balances of the two loan aliernatives? c. What is the incremental cost of borrowing the extra $50.000 with Laan A if you sell the house a the end of Year 5? 3. Again, referring to the loan alternatives in Question 1, let's now assume that Loan B is a 20-year loan instead of a 30-year loan (Loan A remains a 30-year loan). Because a 20-year loan is not as risky to the lender as a 30 -year loan, assume that the 20-year Loan B interest rate is 3.50%. Assume all other loan specifications are as before. Answer the following questions a. What are the monthly payments for the two loan aliernatives? b. What is the difference in monthly payments? c. What is the incremental cost of borrowing the extra 550.000 in Laan A now? 4. Assume that you sell your house at the end of year 5 and then move to Dayton, Ohio. Let's say you've done well with your company and have received a couple of substantial raises, so upon getting to Dayton you buy a more upscale house. Your new house in Dayton costs $375,000. Let's also say that you pay 20% down and borrow the rest, which is $300,000. Assume that when you move to Dayton market interest rates have gone up. You now secure a 30-year, fixed rate mortgage loan for $300,000 at an interest rate of 5.50%. What is your monthly P\&I payment? 5. Let's say that the project you are assigned to is long-term and you are quite happy with your situation at Wright-Patterson AFB. You have assumed other responsibilities for your company and have received promotions accordingly. Even though you could step up into yet an even more upscale house, you have made many improvements to the house you have in Dayton and are quite content with it. Fifteen years after having moved to Dayton market interest rates have fallen significantly. You are considering refinancing your house with a new 15 year mortgage loan. You can now obtain a new 15-year, fixed rate mortgage loan at a nominal interest rate of 3.65%. Closing costs for the refinancing will be $4,150. Answer the following questions. a. What will be the principal balance of your existing mortgage loan at the end of Year 15 (use the PV method as done in the slide)? b. What will the monthly P\&I payment be on the new 15 -year loan? c. What is the difference between the old and new P\&I loan payments? d. Refinancing closing costs can be considered an investment in securing lower monthly P\&I payments. What is the rate of return on your $4,150 1. Assume that yoo were reeently discharged from the US Navy affer six years of active-duty service and have been hired by a defense contractor who is quite interested in your military-acquired skills, knowledge, and experience. To belp induce you to sign with their company, the contractor is paying you an up-front signing bonus of S50,000. You are now considering buying a new bouse for \$250,000. Because of your bothorable serviee, you are eligible for a Veteran Admiaistration (VA) 100:s loan-to-value (LTV) bome loan. VA mortgage loans do not incur PMIl for L.TV ratios of greater than 80\%s ats conventional mortgage loans do. This is because the US goverament insures VA mortgage loans. Let us also say you have a certified 10% VA desability that waives the 1% VA origination fec. You are considering bortowing the entire $250,000 at a nominal annual inierest rate of 4.75%. We'll call this loan altemative Loan A. Alternatively, you could use the $50,000 signing bonus as a down poyment on the house and only borrow 80% of the purchase price, or $200,000, at a rate of 4.25%. We'Il call this loan alhernative Loan B. Both loan alternatives are fived-rate, fully amortizing 30-year loans with monthly payments. What shoold you do? (Hint: Analyze this as the incremental borrowing post of two aliemative loans. Also ignore any escrow ameants in the mosihly payments principul and interest [P\&I] only). a. What are the monthly payment amounts for each loan alkernative? b. What is the difference in the monthly payments? c. What is the incremental cost of bortowing the extra $50,000 in Loan A? 4. What would make Loan A better for you? What would make Loan B betier for you? 2. Continaing with the scenario in Question 1, assume that your new employer has told you that in 5 years the project you will be working on will be transferred to the Air Foree Research Laboratory at Wright-Patterson AFB near Dayton, Ohio. The project is being transferred for further technological development and overall operational support. You will follow the project to Wright-Patterson AFB and work at the air force laboratory as a repecsentative and technical expert for your company. This will resull in yoe being at Wright-Patterson AFB for several years working on this project; hence, yoe decide to sell your new hotse at your current location (the bouse you are buyigg in Question 1). Answer the following questions. a. What are the principal bulances for the two loan alternatives in Qecstion I at the ead of Year 5 (use the FV method as used on the slide presentation)? b. What is the difference between the Year 5 principal balances of the two loan aliernatives? c. What is the incremental cost of borrowing the extra $50.000 with Laan A if you sell the house a the end of Year 5? 3. Again, referring to the loan alternatives in Question 1, let's now assume that Loan B is a 20-year loan instead of a 30-year loan (Loan A remains a 30-year loan). Because a 20-year loan is not as risky to the lender as a 30 -year loan, assume that the 20-year Loan B interest rate is 3.50%. Assume all other loan specifications are as before. Answer the following questions a. What are the monthly payments for the two loan aliernatives? b. What is the difference in monthly payments? c. What is the incremental cost of borrowing the extra 550.000 in Laan A now? 4. Assume that you sell your house at the end of year 5 and then move to Dayton, Ohio. Let's say you've done well with your company and have received a couple of substantial raises, so upon getting to Dayton you buy a more upscale house. Your new house in Dayton costs $375,000. Let's also say that you pay 20% down and borrow the rest, which is $300,000. Assume that when you move to Dayton market interest rates have gone up. You now secure a 30-year, fixed rate mortgage loan for $300,000 at an interest rate of 5.50%. What is your monthly P\&I payment? 5. Let's say that the project you are assigned to is long-term and you are quite happy with your situation at Wright-Patterson AFB. You have assumed other responsibilities for your company and have received promotions accordingly. Even though you could step up into yet an even more upscale house, you have made many improvements to the house you have in Dayton and are quite content with it. Fifteen years after having moved to Dayton market interest rates have fallen significantly. You are considering refinancing your house with a new 15 year mortgage loan. You can now obtain a new 15-year, fixed rate mortgage loan at a nominal interest rate of 3.65%. Closing costs for the refinancing will be $4,150. Answer the following questions. a. What will be the principal balance of your existing mortgage loan at the end of Year 15 (use the PV method as done in the slide)? b. What will the monthly P\&I payment be on the new 15 -year loan? c. What is the difference between the old and new P\&I loan payments? d. Refinancing closing costs can be considered an investment in securing lower monthly P\&I payments. What is the rate of return on your $4,150

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts