Question: Please show the steps to the last question. The question is: What is the net present value of the project if inventories must be increased

Please show the steps to the last question. The question is:

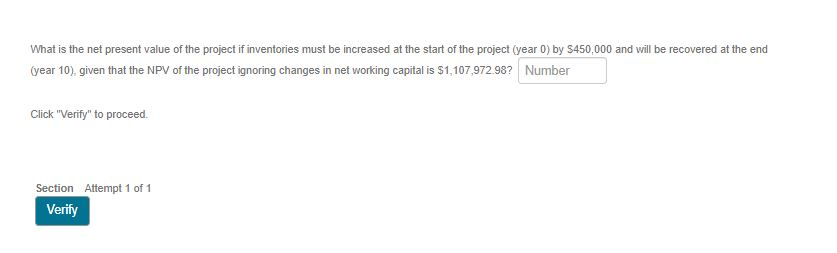

What is the net present value of the project if inventories must be increased at the start of the project (year 0) by $450,000 and will be recovered at the end (year 10), given that the NPV of the project ignoring changes in net working capital is $1,107,972.98?

Thank you :)

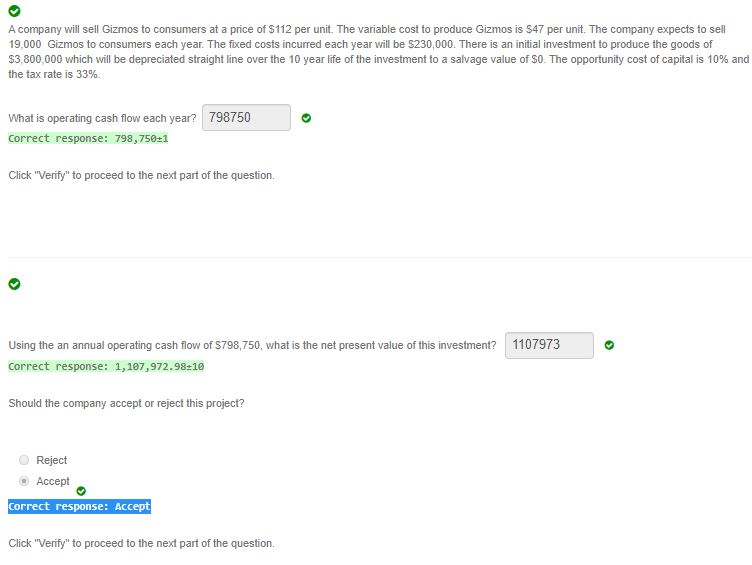

A company will sell Gizmos to consumers at a price of $112 per unit. The variable cost to produce Gizmos is $47 per unit. The company expects to sell 19.000 Gizmos to consumers each year. The fixed costs incurred each year will be $230,000. There is an initial investment to produce the goods of $3,800,000 which will be depreciated straight line over the 10 year life of the investment to a salvage value of $0. The opportunity cost of capital is 10% and the tax rate is 33% What is operating cash flow each year? 798750 Correct response: 798,750:1 Click "Verify" to proceed to the next part of the question. 1107973 Using the an annual operating cash flow of 5798,750, what is the net present value of this investment? Correct response: 1,107,972.98:10 Should the company accept or reject this project? Reject Accept correct response: Accept Click "Verify" to proceed to the next part of the question. What is the net present value of the project if inventories must be increased at the start of the project (year 0) by S450,000 and will be recovered at the end (year 10), given that the NPV of the project ignoring changes in net working capital is $1,107,972.98? Number Click "Verify" to proceed. Section Attempt 1 of 1 Verify

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts