Question: PLEASE SHOW THE VLOOKUP FUNCTION THAT YOU USED TO COMPLETE THE TABLE B E 1 K L M N 0 P Name ID MB ROE

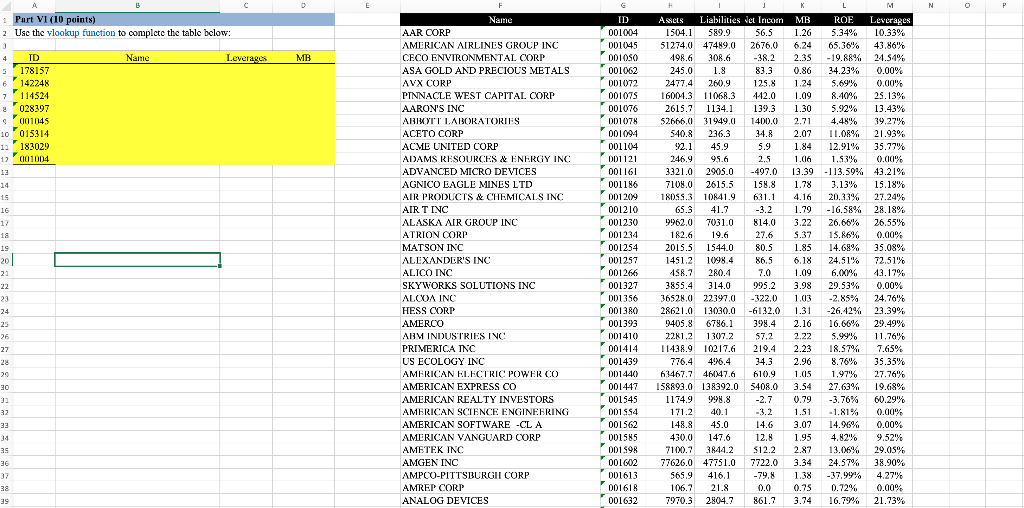

PLEASE SHOW THE VLOOKUP FUNCTION THAT YOU USED TO COMPLETE THE TABLE

B E 1 K L M N 0 P Name ID MB ROE Part VI (10 points) 2 Use the vlookup function to complete the table below: Leverages 10.33% AAR CORP 001004 1.26 5.34% Assets Liabilities Jet Incom 1504.1 589.9 56.5 51274.0 47489.0 2676.0 498.6 308.6 -38.2 3 AMERICAN AIRLINES GROUP INC 001045 6.24 65.36% 43.86% 4 TD Name Leverages MB CECO ENVIRONMENTAL CORP 001050 2.35 -19.88% 24.54% 5 178157 001062 245.0 1.8 83.3 0.86 34.23% 0.00% 6 142248 D01072 125.8 1.24 5.69% 0.00% 114524 001075 442.0 1.09 8.40% 25.13% 028397 001076 1.30 5.92% 13.43% ASA GOLD AND PRECIOUS METALS AVX CORP PINNACLE WEST CAPITAL CORP AARON'S INC ABIWYIT LABORATORIES ACETO CORP ACME UNITED CORP ADAMS RESOURCES & ENERGY INC 2477,4 260.9 1600.3 11068.3 2615.2 1134.1 526100 31949.0 540.8 236.3 92.1 45.9 001045 DD1078 139.3 1400.0 34.8 2.71 4,48% 39.27% 001094 2.07 11.08% 21.93% 10 015314 11 183029 11001004 001104 5.9 1.84 12.91% 35.77% 001121 246.9 95.6 2.5 1.016 1.53% 0.00% 13 ADVANCED MICRO DEVICES 001161 3321.0 2905.0 -497.0 13.39 -113.59% 43.21% 14 001186 7100.0 2615.5 158.8 1.78 15.18% AGNICO EAGLE MINES LTD AIR PRODUCTS A CHEMICALS INC 15 001209 18DSS.3 10841.9 631.1 4.16 3.13% 20.33% - 16.58% 27.24% 16 AIRT INC 001210 65.3 41.7 -3.2 1.79 28.18% 17 001230 9962.0 7031.0 814.0 3.22 26,66% 18 001234 182.6 19.6 27.6 15.86% ALASKA AIR GROUP INC ATRION CORP MATSON INC ALEXANDER'S INC ALICO INC 26.55% 0.00% 35.08% 72.51% 19 001254 2015.5 80.5 1.85 14.68% 201 001257 1451.2 1544.0 1098.4 280.4 86.5 6.18 21 001266 458.7 7.0 1.09 24.51% 6.06% 29.53% 43.17% 22 SKYWORKS SOLUTIONS INC 001327 3855.4 314.0 3.98 0.00% 23 001356 36528.0 22397.0 995.2 -322. -6132.0 1.03 -2.85% 24,76% 24 001380 28621.0 13030.0 1.31 -26.42% 23.39% 25 001393 9405.8 6786.1 398.4 2.16 16.06% 29.49% 26 DD1410 2281.2 1307.2 $7.2 2.22 5.99% 11.76% 27 001414 11438.9 10217.6 219.4 2.23 18.57% 7.65% 28 001439 776.4 496.4 34.3 2.96 8.76% 35.35% 20 DD1440) 63467.7 46147.6 610.9 1.015 1.97% 27.76% 30 001447 158893.0 138392.0 5408.0 3.54 27.63% 19.68% 32 ALCOA INC HESS CORP AMERCO ARM INDUSTRIES INC PRIMERICA INC US ECOLOGY INC AMERICAN ELECTRIC POWER CO AMERICAN EXPRESS CO AMERICAN REALTY INVESTORS AMERICAN SCIENCE ENGINEERING AMERICAN SOFTWARE -CL A AMERICAN VANGUARD CORP AMETEK INC AMGEN INC AMPCO-PITTSBURGH CORP AMREP CORP ANALOG DEVICES 001545 11749 998.8 -2.7 0.79 -3.76% 60.29% 32 DDSS4 171.2 40.1 -3.2 1.51 - 1.81% 0.00% 0.00% 33 001562 148.8 45.0 14.6 3.07 14.96% 001585 430.0 147.6 12.8 1.95 9.52% 35 001398 7100.7 3844.2 $12.2 2.87 36 001602 77626.0 47751.0 7722.0 3.34 4.82% 13.06% 24.57% -37.99% 0.72% 16.799 29.05% 38.90% 4.27% 0.00% 37 001613 416.1 -79,8 1.38 565.9 106.7 38 001618 21.8 0.0 0.25 39 001632 7970.3 2804.7 861.2 3.74 21.73%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts