Question: Please show the work, thanks so much! 20) Use the following tax tables to determine your take-home pay. You contribute 10% to your 401k like

Please show the work, thanks so much!

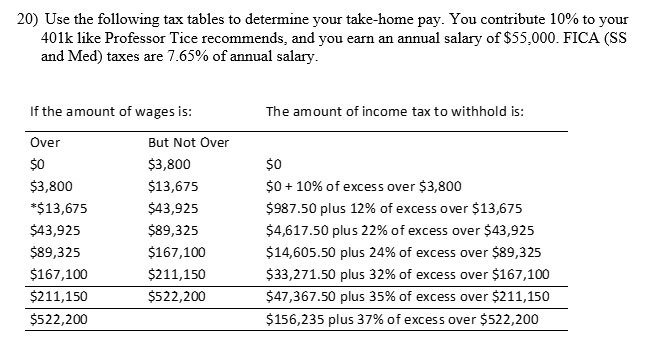

20) Use the following tax tables to determine your take-home pay. You contribute 10% to your 401k like Professor Tice recommends, and you earn an annual salary of $55,000. FICA (SS and Med) taxes are 7.65% of annual salary. If the amount of wages is: The amount of income tax to withhold is: Over $0 $3,800 *$13,675 $43,925 $89,325 $167,100 $211,150 $522,200 But Not Over $3,800 $13,675 $43,925 $89,325 $167,100 $211,150 $522,200 $0 $0 + 10% of excess over $3,800 $987.50 plus 12% of excess over $13,675 $4,617.50 plus 22% of excess er $43,925 $14,605.50 plus 24% of excess over $89,325 $33,271.50 plus 32% of excess over $167,100 $47,367.50 plus 35% of excess over $211,150 $156,235 plus 37% of excess over $522,200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts