Question: please show using excel with formulas Bravo Company is considering a plan to construct a new expand its manufacturing plant to expand its operations. An

please show using excel with formulas

please show using excel with formulas

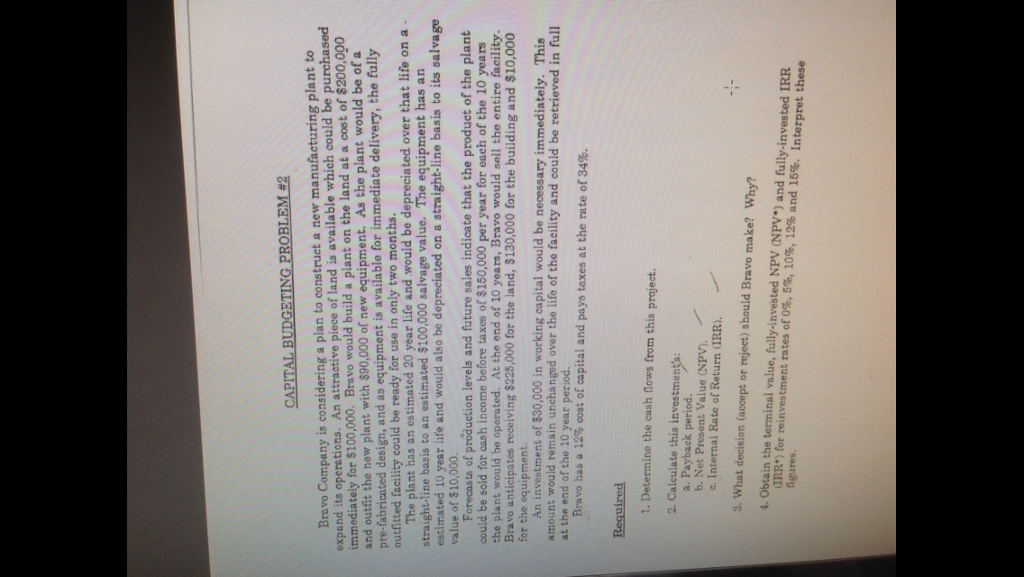

Bravo Company is considering a plan to construct a new expand its manufacturing plant to expand its operations. An attractive piece of land a available which could be purchased immediately for $100,000. Bravo would build a plant on the land at a cost of $2000,000 and outfit the new plant with $90.000 of new equipment. A. pre fabricated design, and as equipment is available for immediate delivery, the fully outfitted facility could be ready for use in only two months. The plant has an estimated 20 year life and would be depreciated over that life on a straight-line basis to an estimated $100,000 salvage value. The equipment has an estimated 10 year life and would also be depreciated on a straight-line basis to its salvage value of $10,000. Forecasts of production levels and future sales indicate that the product of the plant could be sold for cash income before taxes of $150,000 per year for each of the 10 years the plant would be operated. At the end of 10 years, Bravo would sell the entire facility. Bravo anticipates receiving $225,000 for the land, $130,000 for the building and $10,000 for the equipment. An investment of $30,000 in working capital would be necessary immediately. This amount would remain unchanged over the life of the facility and could be retrieved in full at the end of the 10 year period. Bravo has a 12% cost of capital and pays taxes at the rate of 34%. Determine the cash flows from this project. Calculate this investment's: Payback period. Net Present Value (NPV). Internal Rate of Return (IRR). What decision (accept or reject) should Bravo make? Why? Obtain the terminal value, fully-invested NPV (NPV*) and fully-invested IRR (IRR*) for reinvestment rates of 0 %, 5 %, 10%, 12%, and 15%. Interpret these figures

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts