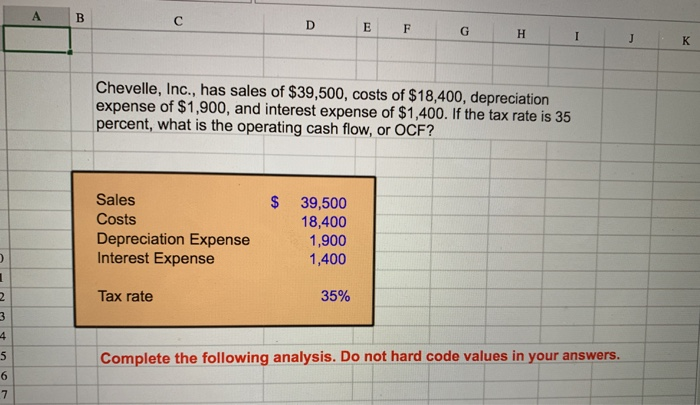

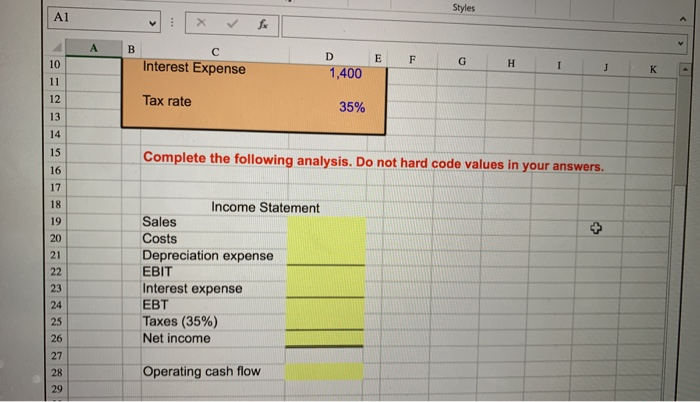

Question: Please show what to write on Excel. For example (=D7+D8) Chevelle, Inc., has sales of $39,500, costs of $18,400, depreciation expense of $1,900, and interest

Chevelle, Inc., has sales of $39,500, costs of $18,400, depreciation expense of $1,900, and interest expense of $1,400. If the tax rate is 35 percent, what is the operating cash flow, or OCF? Sales Costs Depreciation Expense Interest Expense $ 39,500 18,400 1,900 1,400 Tax rate 39% Complete the following analysis. Do not hard code values in your answers. Styles Al 10 Interest Expense 1,400 12 Tax rate 13 15 16 17 Complete the following analysis. Do not hard code values in your answers. Income Statement Sales Costs Depreciation expense EBIT Interest expense EBT Taxes (35%) Net income 21 26 27 28 Operating cash flow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts