Question: Please work in an excel document and if possible please provide the steps. The following information is provided to you about the performance of a

Please work in an excel document and if possible please provide the steps.

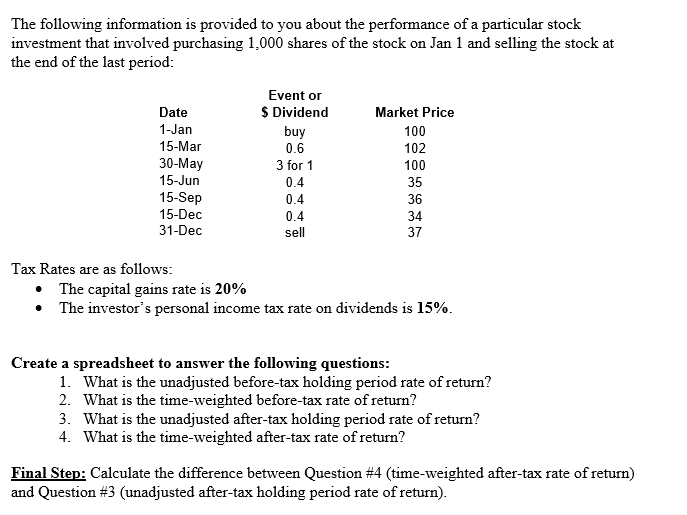

The following information is provided to you about the performance of a particular stock investment that involved purchasing 1,000 shares of the stock on Jan 1 and selling the stock at the end of the last period: Date 1-Jan 15-Mar 30-May 15-Jun 15-Sep 15-Dec 31-Dec Event or $ Dividend buy 0.6 3 for 1 0.4 0.4 0.4 sell Market Price 100 102 100 35 36 34 37 Tax Rates are as follows: The capital gains rate is 20% The investor's personal income tax rate on dividends is 15%. Create a spreadsheet to answer the following questions: 1. What is the unadjusted before-tax holding period rate of return? 2. What is the time-weighted before-tax rate of return? 3. What is the unadjusted after-tax holding period rate of return? 4. What is the time-weighted after-tax rate of return? Final Step: Calculate the difference between Question #4 (time-weighted after-tax rate of return) and Question #3 (unadjusted after-tax holding period rate of return)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts