Question: Please show work 19. A pension fund currently makes payouts to beneficiaries of $1,000,012 per year, with those payouts expected to grow with a forecasted

Please show work

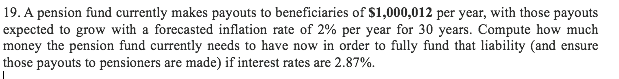

19. A pension fund currently makes payouts to beneficiaries of $1,000,012 per year, with those payouts expected to grow with a forecasted inflation rate of 2% per year for 30 years. Compute how much money the pension fund currently needs to have now in order to fully fund that liability and ensure those payouts to pensioners are made) if interest rates are 2.87%

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock