Question: please show work 3. (5 points) A capital project has an initial investment of $150,000 and cash flows in years 1-6 of $45,000, $25,000, $55,000,

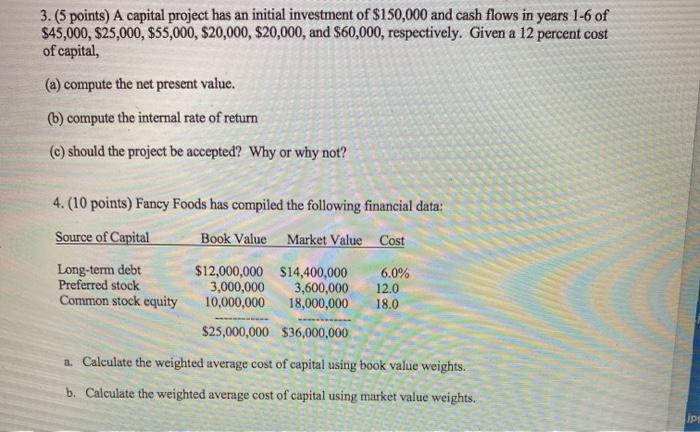

3. (5 points) A capital project has an initial investment of $150,000 and cash flows in years 1-6 of $45,000, $25,000, $55,000, $20,000, $20,000, and $60,000, respectively. Given a 12 percent cost of capital, (a) compute the net present value. 6) compute the internal rate of return () should the project be accepted? Why or why not? 4. (10 points) Fancy Foods has compiled the following financial data: Source of Capital Book Value Market Value Cost Long-term debt Preferred stock Common stock equity $12,000,000 $14,400,000 3,000,000 3,600,000 10,000,000 18,000,000 6.0% 12.0 18.0 $25,000,000 $36,000,000 1. Calculate the weighted average cost of capital using book value weights. b. Calculate the weighted average cost of capital using market value weights. JP

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts