Question: please show work! 4. (30 points) Determine whether the following contract described below is worthwhile of undertaking after taxes if at the end of the

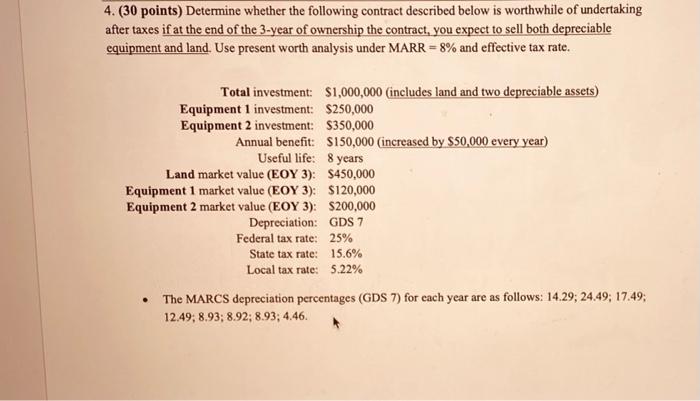

4. (30 points) Determine whether the following contract described below is worthwhile of undertaking after taxes if at the end of the 3-year of ownership the contract, you expect to sell both depreciable equipment and land. Use present worth analysis under MARR = 8% and effective tax rate. Total investment: $1,000,000 (includes land and two depreciable assets) Equipment 1 investment: $250,000 Equipment 2 investment: $350,000 Annual benefit: $150,000 (increased by $50,000 every year) Useful life: 8 years Land market value (EOY 3): $450,000 Equipment 1 market value (EOY 3): $120,000 Equipment 2 market value (EOY 3): $200,000 Depreciation: GDS 7 Federal tax rate: 25% State tax rate: 15.6% Local tax rate: 5.22% The MARCS depreciation percentages (GDS 7) for each year are as follows: 14.29; 24.49; 17.49; 12.49; 8.93; 892; 8.93; 4.46

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts