Question: x 5 Interest rate risk - Excel ? X FILE HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW Sign In Calibri 11 - A %

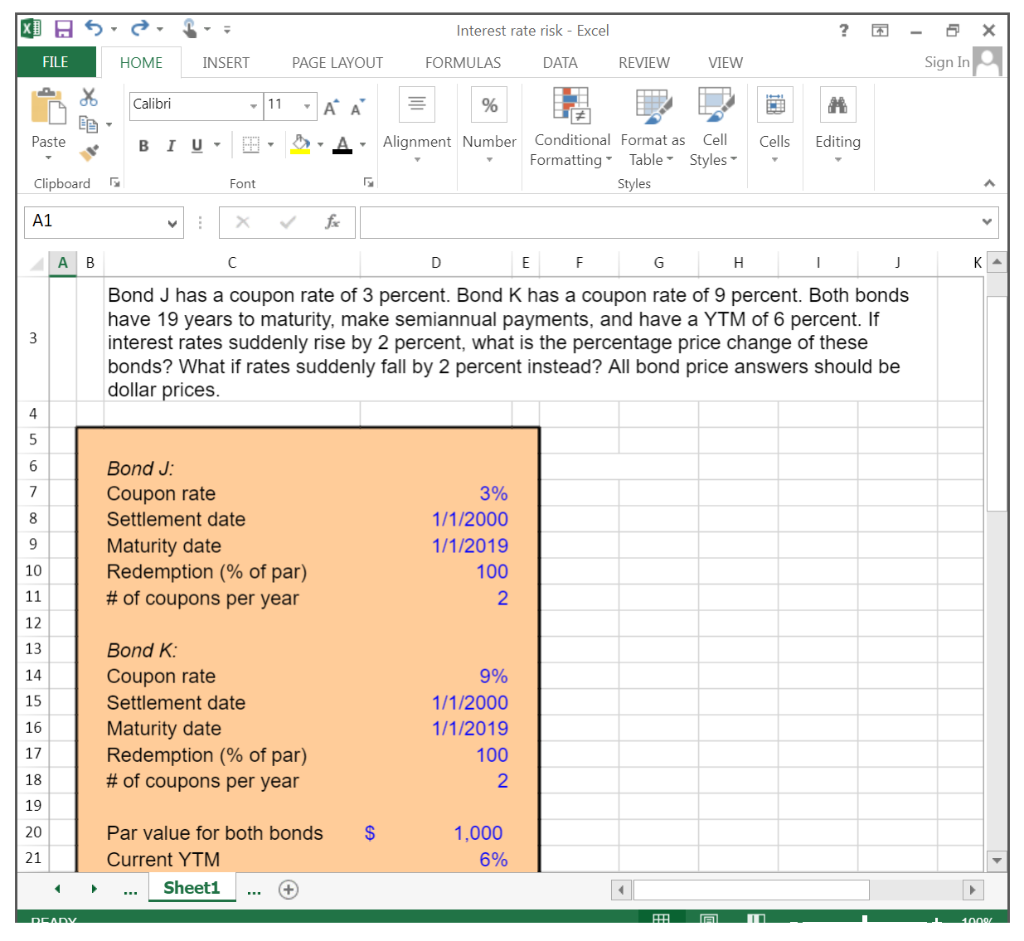

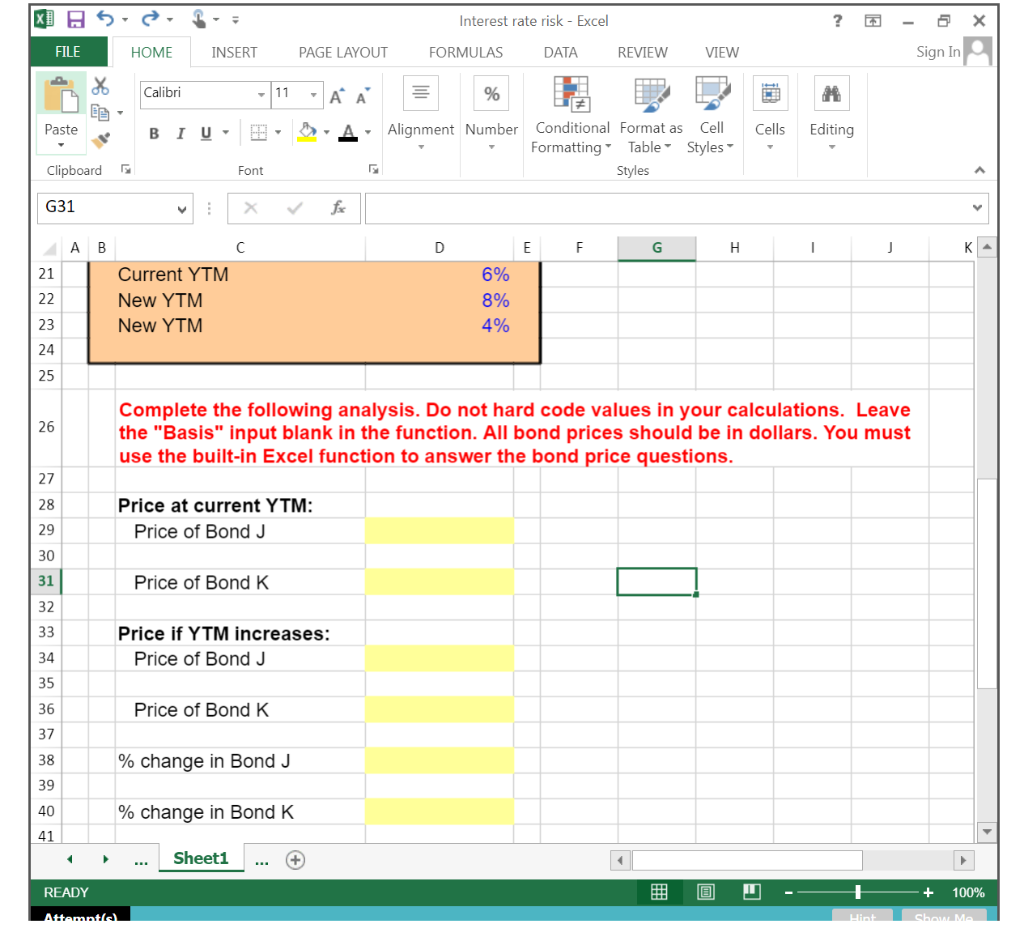

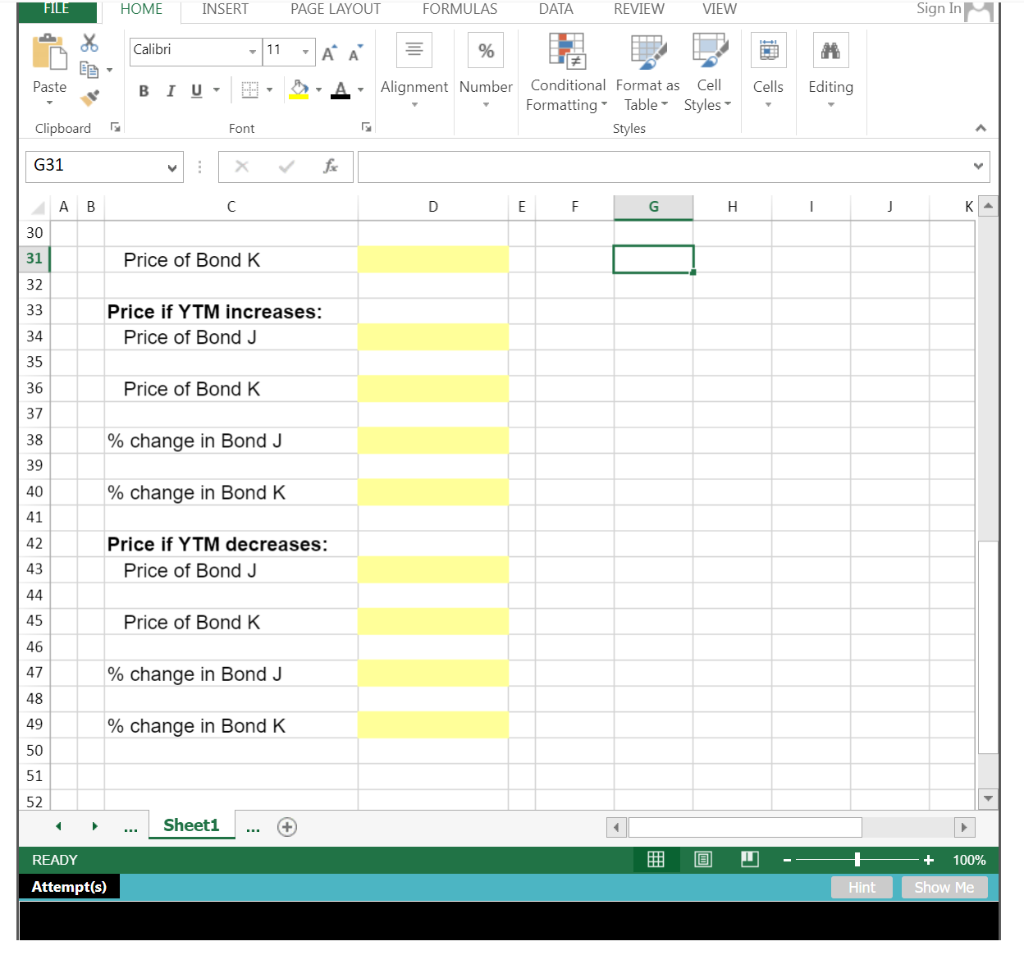

x 5 Interest rate risk - Excel ? X FILE HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW Sign In Calibri 11 - A % Paste BIU Cells Editing Alignment Number Conditional Format as Cell Formatting Table Styles Styles Clipboard Font A1 fx A B D E F G H 1 J Bond J has a coupon rate of 3 percent. Bond K has a coupon rate of 9 percent. Both bonds have 19 years to maturity, make semiannual payments, and have a YTM of 6 percent. If interest rates suddenly rise by 2 percent, what is the percentage price change of these bonds? What if rates suddenly fall by 2 percent instead? All bond price answers should be dollar prices. 4 5 6 7 8 Bond J: Coupon rate Settlement date Maturity date Redemption (% of par) # of coupons per year 9 3% 1/1/2000 1/1/2019 100 2 10 11 12 13 14 15 Bond K: Coupon rate Settlement date Maturity date Redemption (% of par) # of coupons per year 16 17 9% 1/1/2000 1/1/2019 100 2 18 19 20 $ Par value for both bonds Current YTM 1,000 6% 21 Sheet1 DEADY HI 41000 x A5 Interest rate risk - Excel ? FILE HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW Sign In Calibri 11 AA % Paste BIU A- Alignment Number Cells Editing Conditional Format as Cell Formatting Table Styles Styles Clipboard Font G31 X fo AB c D E F G H 1 J KA 21 22 Current YTM New YTM New YTM 6% 8% 4% 23 24 25 26 Complete the following analysis. Do not hard code values in your calculations. Leave the "Basis" input blank in the function. All bond prices should be in dollars. You must use the built-in Excel function to answer the bond price questions. 27 28 Price at current YTM: Price of Bond J 29 30 31 Price of Bond K 32 33 Price if YTM increases: Price of Bond J 34 35 36 Price of Bond K 37 38 % change in Bond J 39 40 % change in Bond K 41 Sheet1 READY Hii 100% Attemntia Show Me FILE HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW Sign In Calibri 11 PA % Paste BIU- Cells Editing Alignment Number Conditional Format as Cell Formatting Table Styles Styles Clipboard Font G31 y AB D E F G H 1 J 30 31 Price of Bond K 32 33 Price if YTM increases: Price of Bond J 34 35 36 Price of Bond K 37 38 % change in Bond J 39 40 % change in Bond K 41 42 Price if YTM decreases: Price of Bond J 43 44 45 Price of Bond K 46 47 % change in Bond J 48 49 % change in Bond K 50 51 52 Sheet1 B 11 READY Attempt(s) 100% Show Me Hint

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts