Question: Please show work and do not use Excel! Thanks Question 6 10 out of 12 points A 12% semiannual paying coupon bond has six years

Please show work and do not use Excel! Thanks

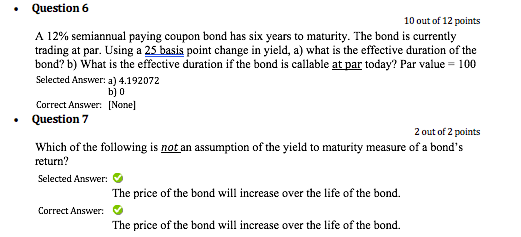

Question 6 10 out of 12 points A 12% semiannual paying coupon bond has six years to maturity. The bond is currently trading at par. Using a 25 basis point change in yield, a) what is the effective duration of the bond? b) What is the effective duration if the bond is callable at par today? Par value = 100 Selected Answer: a) 4.192072 b) 0 Correct Answer: [None) Question 7 2 out of 2 points Which of the following is not an assumption of the yield to maturity measure of a bond's return? Selected Answer: The price of the bond will increase over the life of the bond. Correct Answer: The price of the bond will increase over the life of the bond. Question 6 10 out of 12 points A 12% semiannual paying coupon bond has six years to maturity. The bond is currently trading at par. Using a 25 basis point change in yield, a) what is the effective duration of the bond? b) What is the effective duration if the bond is callable at par today? Par value = 100 Selected Answer: a) 4.192072 b) 0 Correct Answer: [None) Question 7 2 out of 2 points Which of the following is not an assumption of the yield to maturity measure of a bond's return? Selected Answer: The price of the bond will increase over the life of the bond. Correct Answer: The price of the bond will increase over the life of the bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts