Question: please show work and don not copy and paste Geometric Average Returns, Arithmetic Returns & Standard Deviations SHOW WORK ... NO WORK NO POINTS Assume

please show work and don not copy and paste

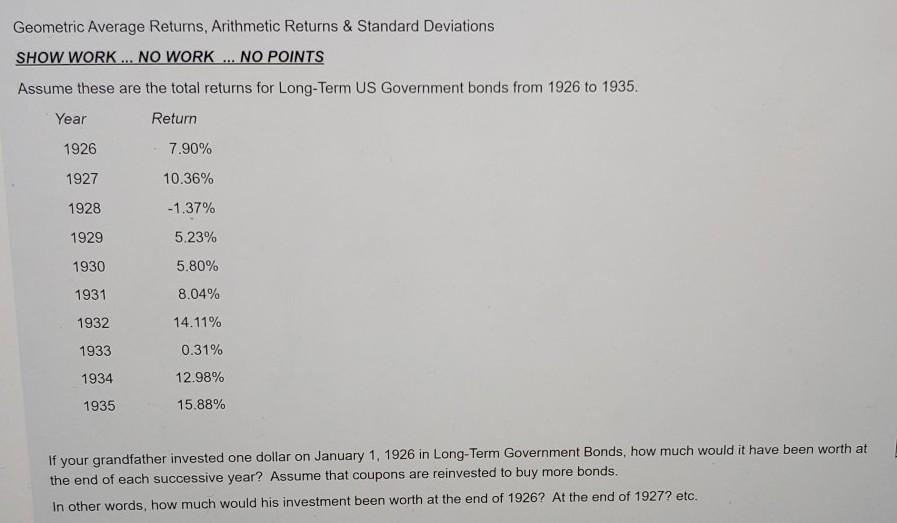

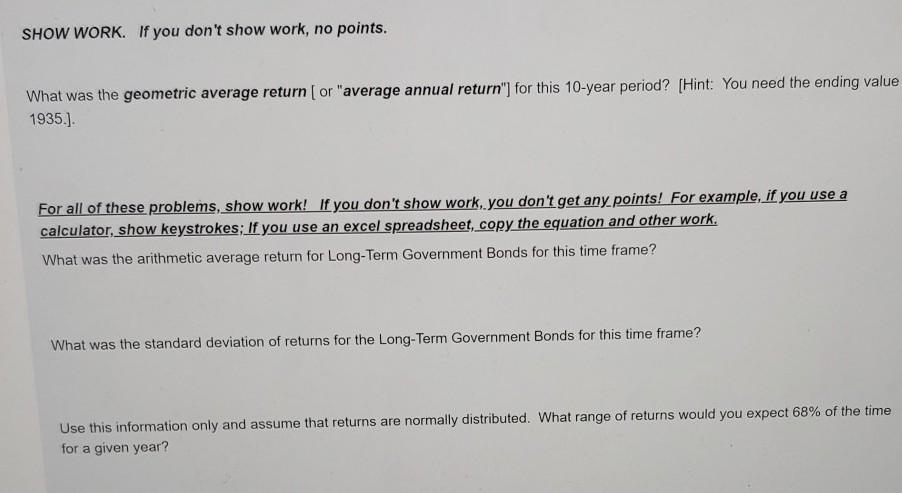

Geometric Average Returns, Arithmetic Returns & Standard Deviations SHOW WORK ... NO WORK NO POINTS Assume these are the total returns for Long-Term US Government bonds from 1926 to 1935. Year Return 1926 7.90% 1927 10.36% 1928 -1.37% 1929 5.23% 1930 5.80% 1931 8.04% 1932 14.11% 1933 0.31% 1934 12.98% 1935 15.88% your grandfather invested one dollar on January 1, 1926 in Long-Term Government Bonds, how much would it have been worth at the end of each successive year? Assume that coupons are reinvested to buy more bonds. In other words, how much would his investment been worth at the end of 1926? At the end of 1927? etc. SHOW WORK. If you don't show work, no points. What was the geometric average return (or "average annual return") for this 10-year period? (Hint: You need the ending value 1935.) For all of these problems, show work! If you don't show work, you don't get any points! For example, if you use a calculator, show keystrokes: If you use an excel spreadsheet, copy the equation and other work. What was the arithmetic average return for Long-Term Government Bonds for this time frame? What was the standard deviation of returns for the Long-Term Government Bonds for this time frame? Use this information only and assume that returns are normally distributed. What range of returns would you expect 68% of the time for a given year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts