Question: Please show work and explain 22) The ending bank statement balance at November 30 is $6,750. The bank statement shows a service charge of $95,

Please show work and explain

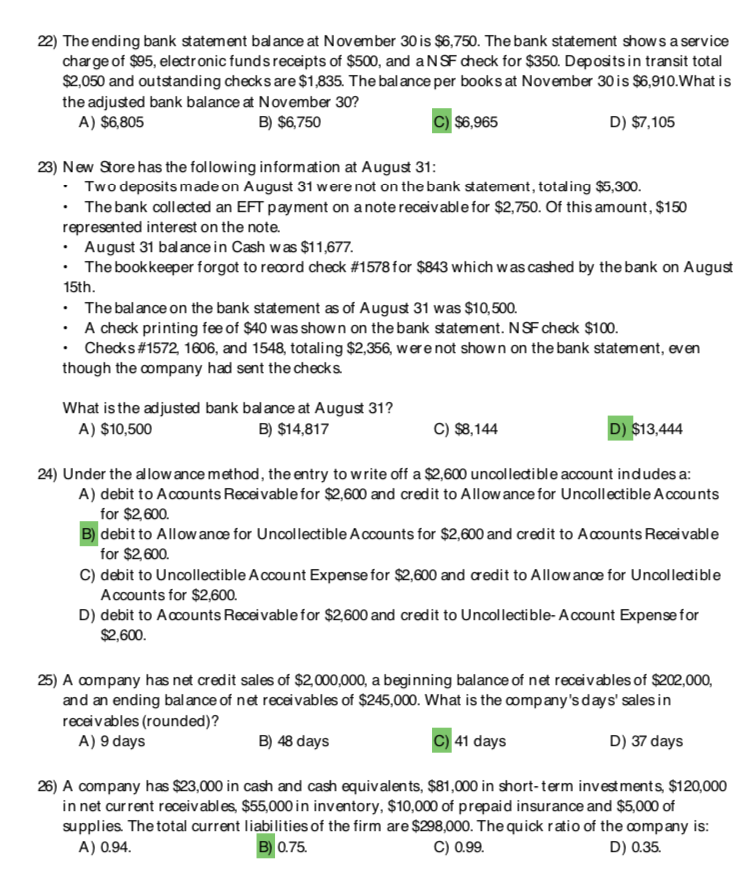

22) The ending bank statement balance at November 30 is $6,750. The bank statement shows a service charge of $95, electronic funds receipts of $500, and a N SF check for $350. Depositsin transit total $2,050 and outstanding checks are $1,835. The balance per books at November 30 is $6,910.What is the adjusted bank balance at November 30? A) $6,805 C) $6,965 D) $7,105 B) $6,750 23) New Store has the following information at August 31: Two deposits made on August 31 were not on the bank statement, totaling $5,300. The bank collected an EFT payment on anote receivablee for $2,750. Of this amount, $150 represented interest on the note. August 31 balance in Cash was $11,677. The bookkeeper forgot to record check #1578 for $843 which was cashed by the bank on August 15th The balance on the bank statement as of August 31 was $10,500. A check printing fee of $40 was shown on the bank statement. N SF check $100. Checks #1572, 1606, and 1548 totaling $2,356, were not shown on the bank statement, even though the company had sent the checks What is the ad justed bank balance at August 31? A) $10,500 D) $13,444 B) $14,817 C) $8,144 24) Under the allow ance method, the entry to write off a $2,600 uncolledible account indudes a A) debit to Accounts Receivable for $2,600 and credit to Allow ance for Uncollectible Accounts for $2,600. B) debit to Allow anoe for Uncollectible Accounts for $2,600 and credit to Accounts Receivable for $2,600 C) debit to Uncollectible Account Expense for $2,600 and aredit to Allow anoe for Uncollectible Accounts for $2,600. D) debit to Accounts Receivable for $2,600 and credit to Uncollectible-Account Expense for $2,600. 25) A company has net credit sales of $2,000,000, a beginning balance of net receivables of $202,000, and an ending balance of net receivables of $245,000. What is the company's days' sales in receivables (rounded)? A) 9 days C) 41 days B) 48 days D) 37 days 26) A company has $23,000 in cash and cash equivalents, $81,000 in short-term investments, $120,000 in net current receivabl es, $55,000 in inventory, $10,000 of prepaid insurance and $5,000 of supplies. The total current liabilities of the firm are $298,000. The quick ratio of the company is A) 0.94. B 0.75 C) 0.99 D) 0.35

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts