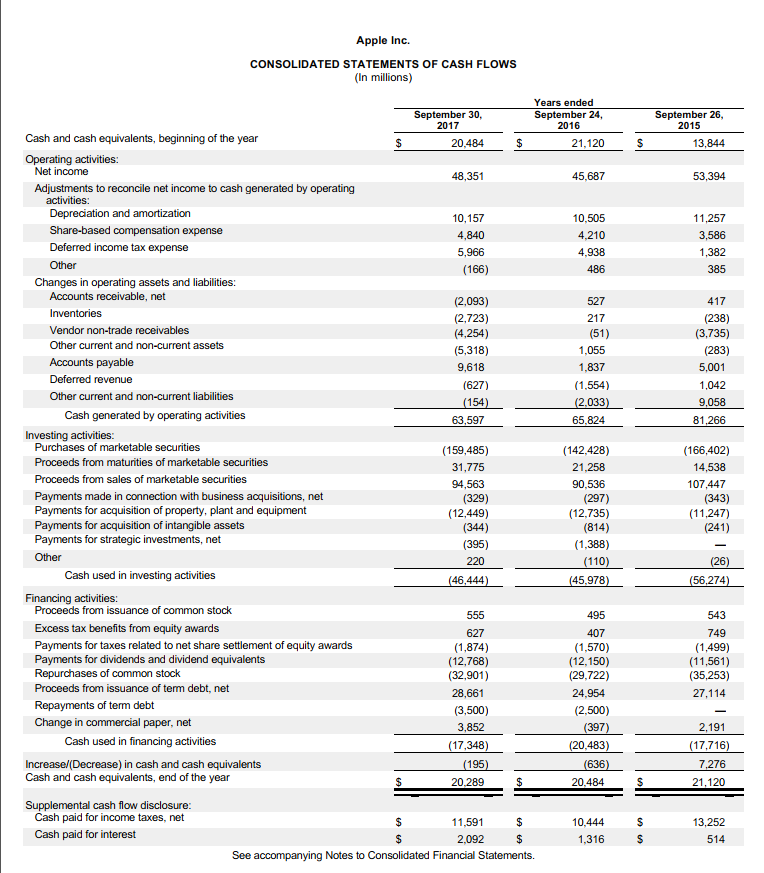

Question: please show work and explain. i am trying to learn. Other than depreciation and amortization, what was the largest non-cash expense that was added back

please show work and explain. i am trying to learn.

- Other than depreciation and amortization, what was the largest non-cash expense that was added back to net income to derive Operating cash flows for the fiscal year ended September 30, 2017? choose one

Share-based compensation expense

Deferred income tax expense

Other

Accounts payable

Deferred revenue

2. If share-based compensation had been $5,660 instead of $4,840, what effect would it have had on operating cash flow? Assume a 0% tax rate. choose one

Increase by $820

Decrease by $820

No change

Not possible to tell with information given

3. How much was free cash flow for the fiscal year ended September 30, 2017?

4. Did deferred revenue increase or decrease during the fiscal year ended September 30, 2017? choose one

Increased

Decreased

5. What was the change in deferred revenue for the fiscal year ended September 30, 2017?

Apple Inc. CONSOLIDATED STATEMENTS OF CASH FLOWS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts