Question: Please show work and explanation. NO NEED TO USE EXCEL!!!! PLEASE SHOW WORK!!! Jack is a self-employed consult. During 2022, he earned income of $32,000

Please show work and explanation. NO NEED TO USE EXCEL!!!! PLEASE SHOW WORK!!!

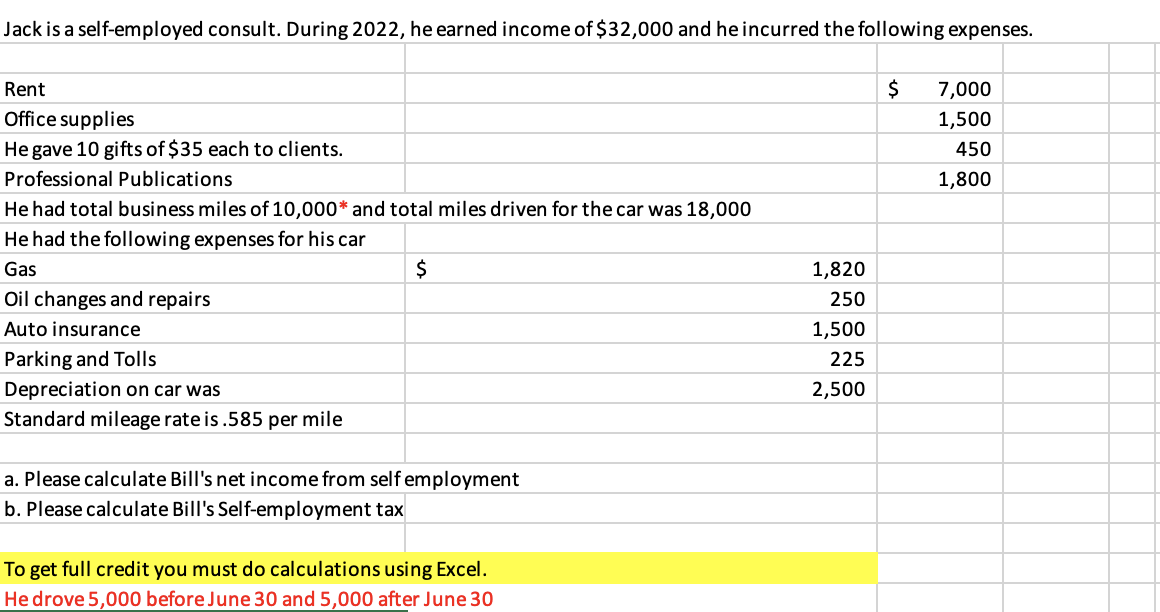

Jack is a self-employed consult. During 2022, he earned income of $32,000 and he incurred the following expenses. Rent Office supplies He gave 10 gifts of $35 each to clients. Professional Publications He had total business miles of 10,000 and total miles driven for the car was 18,000 He had the following expenses for his car Gas Oil changes and repairs Auto insurance Parking and Tolls Depreciation on car was $7,0001,5004501,800 Standard mileage rate is .585 per mile a. Please calculate Bill's net income from self employment b. Please calculate Bill's Self-employment tax To get full credit you must do calculations using Excel. He drove 5,000 before June 30 and 5,000 after June 30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts