Question: Please show Work and write neatly 9, Zero rates in both the US and Britain are flat at 4% per annum with annual compounding. In

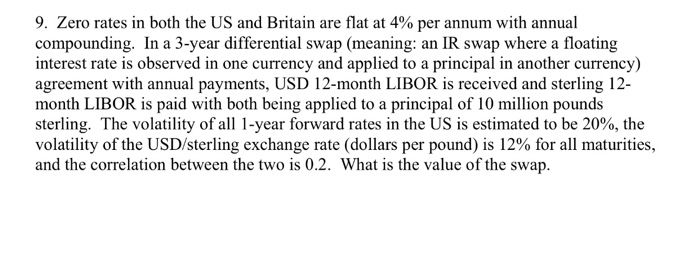

9, Zero rates in both the US and Britain are flat at 4% per annum with annual compounding. In a 3-year differential swap (meaning: an IR swap where a floating interest rate is observed in one currency and applied to ap agreement with annual payments, USD 12-month LIBOR is received and sterling 12- month LIBOR is paid with both being applied to a principal of 10 million pounds sterling. The volatility of all 1-year forward rates in the US is estimated to be 20%, the volatility of the USD/sterling exchange rate (dollars per pound) is 12% for all maturities, and the correlation between the two is 0.2. What is the value of the swap. al in another currency) 9, Zero rates in both the US and Britain are flat at 4% per annum with annual compounding. In a 3-year differential swap (meaning: an IR swap where a floating interest rate is observed in one currency and applied to ap agreement with annual payments, USD 12-month LIBOR is received and sterling 12- month LIBOR is paid with both being applied to a principal of 10 million pounds sterling. The volatility of all 1-year forward rates in the US is estimated to be 20%, the volatility of the USD/sterling exchange rate (dollars per pound) is 12% for all maturities, and the correlation between the two is 0.2. What is the value of the swap. al in another currency)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts