Question: Please show work. Answer part b. (13 points) Nadia (age 40) and Sven (age 42) received the following amounts during 2020: Salary $82.000 Interest on

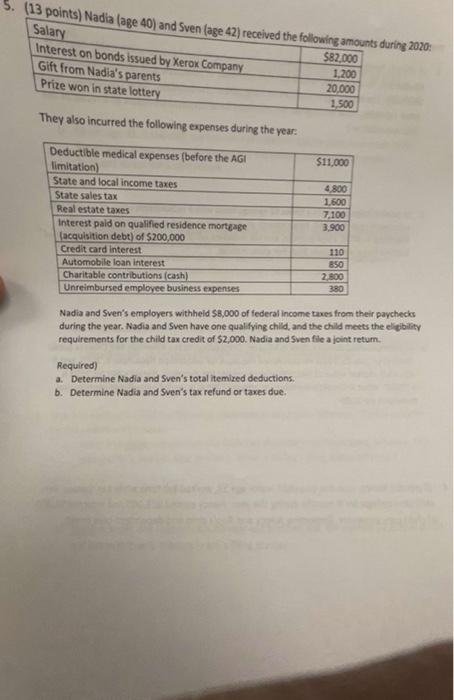

(13 points) Nadia (age 40) and Sven (age 42) received the following amounts during 2020: Salary $82.000 Interest on bonds issued by Xerox Company 1.200 Gift from Nadia's parents 20.000 Prize won in state lottery 1,500 They also incurred the following expenses during the year: $11,000 4.800 Deductible medical expenses (before the AGI limitation) State and local income taxes State sales tax Real estate taxes Interest paid on qualified residence mortgage (acquisition debt) of $200,000 Credit card interest Automobile loan interest Charitable contributions (cash) Unreimbursed employee business expenses 1.600 7.100 3.900 110 850 2.800 380 Nadia and Sven's employers withheld 58,000 of federal income taxes from their paychecks during the year. Nadia and Sven have one qualifying child, and the child meets the eligibility requirements for the child tax credit of $2,000. Nadia and Sven file a joint retum. Required) a. Determine Nadia and Sven's total itemized deductions b. Determine Nadia and Sven's tax refund or taxes due

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts