Question: please show work (Complex annuity payments) Minouse, 21, is about to begin his career as a rocket scientigt for a NaSA contractor. As a rocket

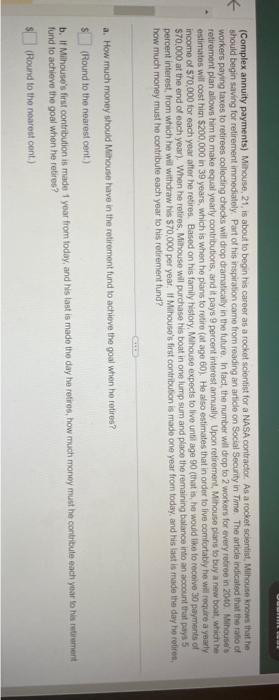

(Complex annuity payments) Minouse, 21, is about to begin his career as a rocket scientigt for a NaSA contractor. As a rocket scientist, Muilhouse krows itat he bhould begin saving for retirement immedialely. Part of his itspilation came from reading an article on Soctal Security in Time The article indicated that the fafio of workers payng taxes to retirees collecting checks will diop dramaticaly in the future. In fact. the number wil drop to 2 workers for every retree in 2 Hto. Milhcustis retirement plan allows him to make equal yearly contrbutions, and it pays 9 parcent interest annually, Upon telirement, Minouse plaris to bey a near boat, which here estimates wif cost him $200,000 in 39 years, which is when he plans to retire fat ape 60 ). He also estimates that in order to five comfortably fie well require a yealy income or 570,000 tor each year after he retires. Basod on his family history, Milhouse expecis to live unht age 90 (that is, he would like fo recelvo 30 paymients of $70.000 at the end of each year). When he retires, Miavouse will purchase his boat in orve lump sum and piace the remaining balance into an account etat pays 5 percent interest, from which he will withdraw his $70,000 per year. If Mihouso's first contribubon is made one year froen today, and his list is frude the day he reuret. Tow much money must the contribute each year to his retirement fund? a. How much money should Minouse have -in the retirement fund to achieve the goal when he retires? (Round to the nearest cent:) fund to achiove the goal when he reties? (Round to the noarest cont.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts