Question: please show work for 4 and 5 4) During 2019, Magee Auto Supply Outlets had gross sales of $900,000, cost of goods sold of $300,000,

please show work for 4 and 5

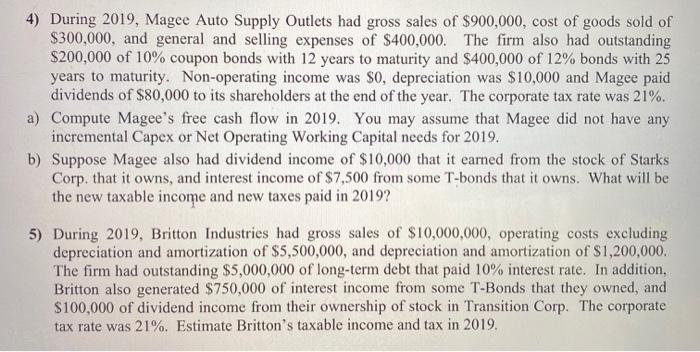

please show work for 4 and 5 4) During 2019, Magee Auto Supply Outlets had gross sales of $900,000, cost of goods sold of $300,000, and general and selling expenses of $400,000. The firm also had outstanding $200,000 of 10% coupon bonds with 12 years to maturity and $400,000 of 12% bonds with 25 years to maturity. Non-operating income was $0, depreciation was $10,000 and Magee paid dividends of $80,000 to its shareholders at the end of the year. The corporate tax rate was 21%. a) Compute Magee's free cash flow in 2019. You may assume that Magee did not have any incremental Capex or Net Operating Working Capital needs for 2019. b) Suppose Magee also had dividend income of $10,000 that it earned from the stock of Starks Corp. that it owns, and interest income of $7,500 from some T-bonds that it owns. What will be the new taxable income and new taxes paid in 2019? 5) During 2019, Britton Industries had gross sales of $10,000,000, operating costs excluding depreciation and amortization of $5,500,000, and depreciation and amortization of $1,200,000. The firm had outstanding $5,000,000 of long-term debt that paid 10% interest rate. In addition, Britton also generated $750,000 of interest income from some T-Bonds that they owned, and $100,000 of dividend income from their ownership of stock in Transition Corp. The corporate tax rate was 21%. Estimate Britton's taxable income and tax in 2019, 4) During 2019, Magee Auto Supply Outlets had gross sales of $900,000, cost of goods sold of $300,000, and general and selling expenses of $400,000. The firm also had outstanding $200,000 of 10% coupon bonds with 12 years to maturity and $400,000 of 12% bonds with 25 years to maturity. Non-operating income was $0, depreciation was $10,000 and Magee paid dividends of $80,000 to its shareholders at the end of the year. The corporate tax rate was 21%. a) Compute Magee's free cash flow in 2019. You may assume that Magee did not have any incremental Capex or Net Operating Working Capital needs for 2019. b) Suppose Magee also had dividend income of $10,000 that it earned from the stock of Starks Corp. that it owns, and interest income of $7,500 from some T-bonds that it owns. What will be the new taxable income and new taxes paid in 2019? 5) During 2019, Britton Industries had gross sales of $10,000,000, operating costs excluding depreciation and amortization of $5,500,000, and depreciation and amortization of $1,200,000. The firm had outstanding $5,000,000 of long-term debt that paid 10% interest rate. In addition, Britton also generated $750,000 of interest income from some T-Bonds that they owned, and $100,000 of dividend income from their ownership of stock in Transition Corp. The corporate tax rate was 21%. Estimate Britton's taxable income and tax in 2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts