Question: please show work for all questions!!! :) 2) The Stone Harbor Fund is a closed-end investment company with a portfolio currently worth $300 million. It

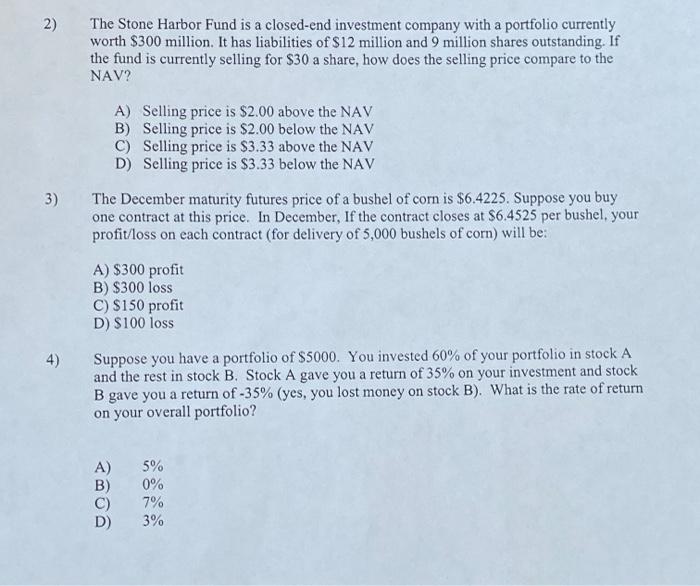

2) The Stone Harbor Fund is a closed-end investment company with a portfolio currently worth $300 million. It has liabilities of $12 million and 9 million shares outstanding. If the fund is currently selling for $30 a share, how does the selling price compare to the NAV? A) Selling price is $2.00 above the NAV B) Selling price is $2.00 below the NAV C) Selling price is $3.33 above the NAV D) Selling price is $3.33 below the NAV 3) 3 The December maturity futures price of a bushel of corn is $6.4225. Suppose you buy one contract at this price. In December, If the contract closes at $6.4525 per bushel, your profit/loss on each contract (for delivery of 5,000 bushels of corn) will be: A) $300 profit B) $300 loss C) $150 profit D) $100 loss 4) Suppose you have a portfolio of $5000. You invested 60% of your portfolio in stock A and the rest in stock B. Stock A gave you a return of 35% on your investment and stock B gave you a return of -35% (yes, you lost money on stock B). What is the rate of return on your overall portfolio? A) B) C) D) 5% 0% 7% 3%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts