Question: please show work for both part a and b Problem 2 (20 points) You are considering investing in three different assets. The first is a

please show work for both part a and b

please show work for both part a and b

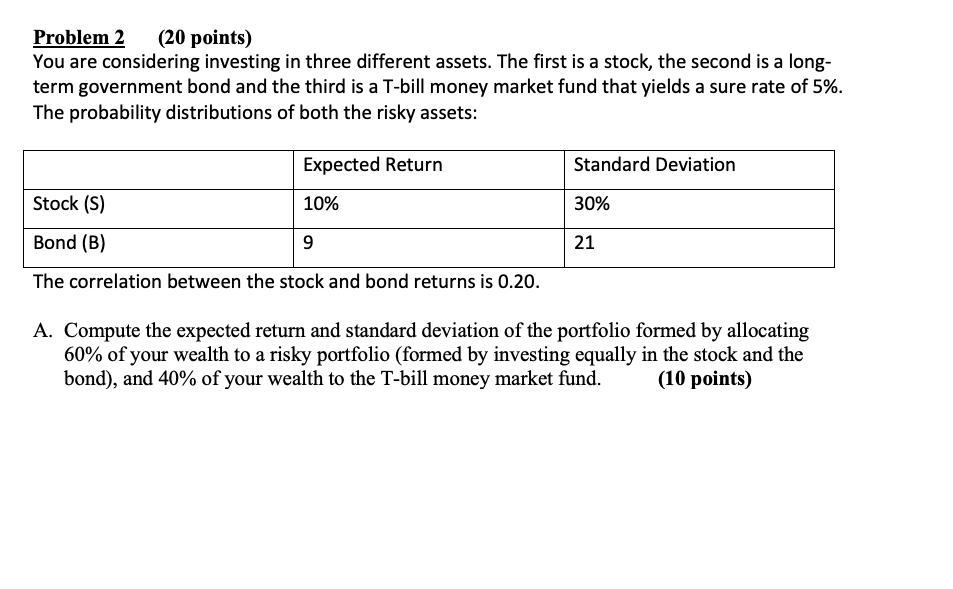

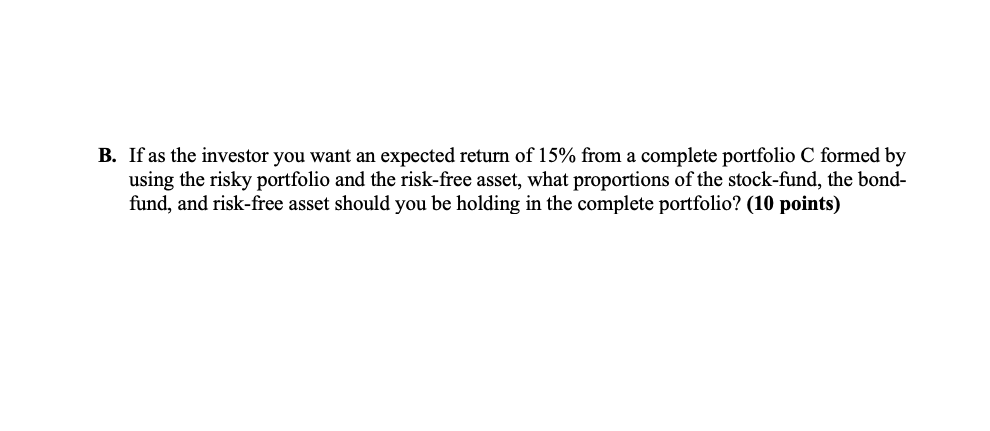

Problem 2 (20 points) You are considering investing in three different assets. The first is a stock, the second is a long- term government bond and the third is a T-bill money market fund that yields a sure rate of 5%. The probability distributions of both the risky assets: Expected Return Standard Deviation Stock (S) 10% 30% Bond (B) 9 21 The correlation between the stock and bond returns is 0.20. A. Compute the expected return and standard deviation of the portfolio formed by allocating 60% of your wealth to a risky portfolio (formed by investing equally in the stock and the bond), and 40% of your wealth to the T-bill money market fund. (10 points) B. If as the investor you want an expected return of 15% from a complete portfolio C formed by using the risky portfolio and the risk-free asset, what proportions of the stock-fund, the bond- fund, and risk-free asset should you be holding in the complete portfolio? (10 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts