Question: PLEASE SHOW WORK FOR EACH ANSWER - THANKS! Vapor Trails - Calculate the following Ratios for 2013 A. Market to Book Ratio B. Debt to

PLEASE SHOW WORK FOR EACH ANSWER - THANKS!

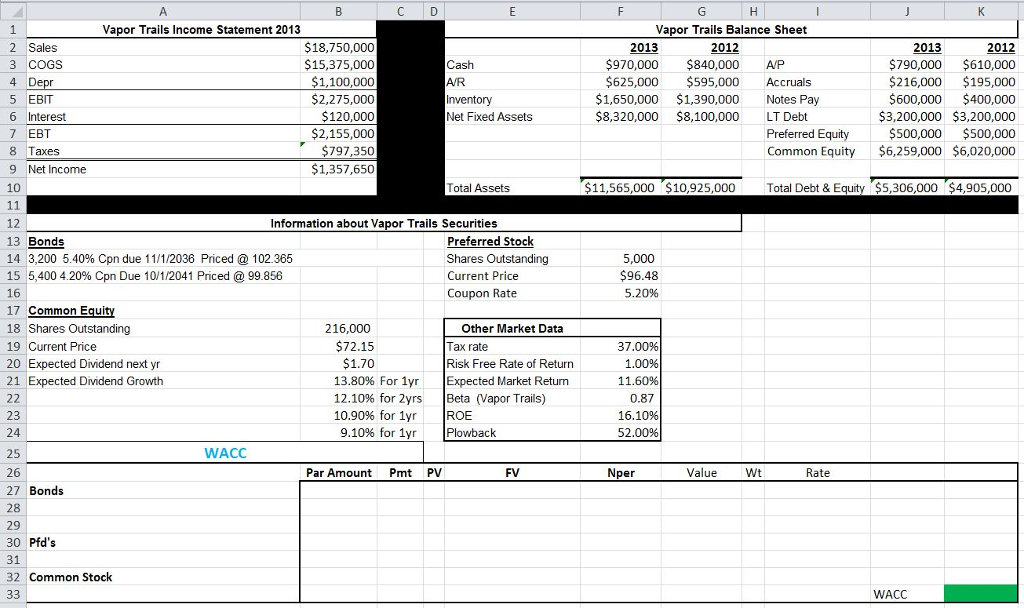

| Vapor Trails - Calculate the following Ratios for 2013 | |

| A. Market to Book Ratio | |

| B. Debt to Equity | |

| C. Days in Inventory | |

| D. Cash Coverage Ratio | |

| E. Return on Assets |

Vapor Trails Income Statement 2013 Vapor Trails Balance Sheet $18,750,000 2 Sales 2013 2013 $15,375,000 $970,000 $840,000 AP $790,000 $610,000 3 COGS Cas $625,000 $595,000 Accruals $1,100,000 $216,000 $195,000 4 Depr $2,275,000 $1,650,000 $1,390,000 Notes Pay $600,000 $400,000 5 EBIT Inventory $8,320,000 $8,100,000 LT Debt $120,000 $3,200,000 $3,200,000 6 Interest Net Fixed Assets $2,155,000 $500,000 $500,000 7 EBT Preferred Equity $797,350 Common Equity $6,259,000 $6,020,000 8 T axes $1,357,650 9 Net Income $11,565,000 $10,925,000 otal Debt & Equity $5,306,000 $4,905,000 10 Total Assets 11 12 Information about Vapor Trails Securities Preferred Stock 13 Bonds 14 3,200 5.40% Cpn due /2036 Priced a 102.365 Shares outstanding $96.48 15 5,400 4.20% Cpn Due 10/1/2041 Priced 99.856 Current Price 16 5.20% Coupon Rate 17 Common Equ 18 Shares Outstanding 216,000 Other Market Data $72.15 19 Current Price Tax rate 37.00% $1.70 20 Expected Dividend next yr Risk Free Rate of Return 1.00% 21 Expected Dividend Growth 13.80% For lyr Expected Market Return 11.60% 12.10% for 2yrs Beta Vapor Trails 22 0.87 10.90% for 1yr 23 ROE 16.109% 9.10% for lyr Plowback 24 52.00% WACC 25 26 Par Amount Pmt PV FV Nper Value Wt Rate Bonds 27 28 29 Pfd's. 30 31 32 Common Stock 33

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts