Question: Please help ASAP! Will leave a good score Required Calculate the following ratios for Year 4 and Year 3 . o. Working capital. h. Curront

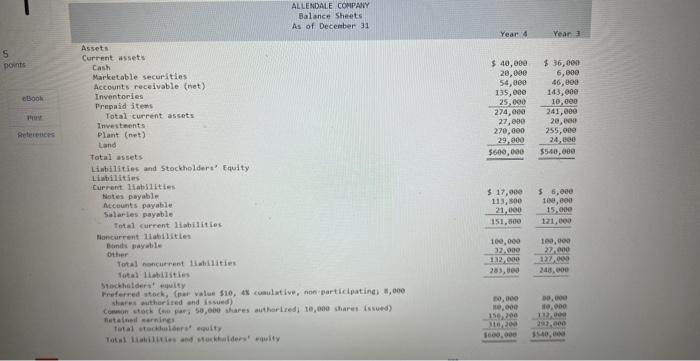

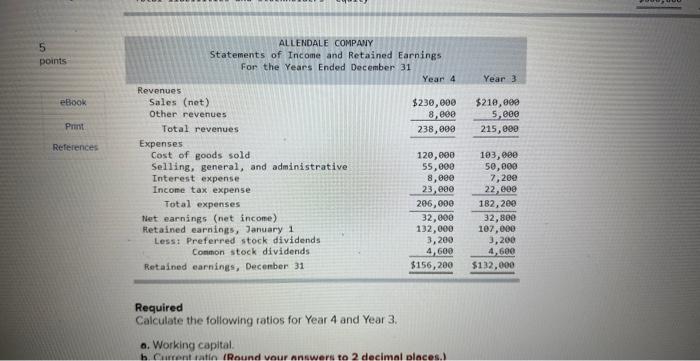

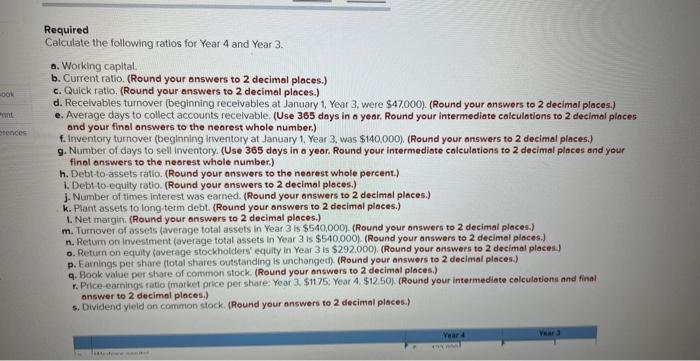

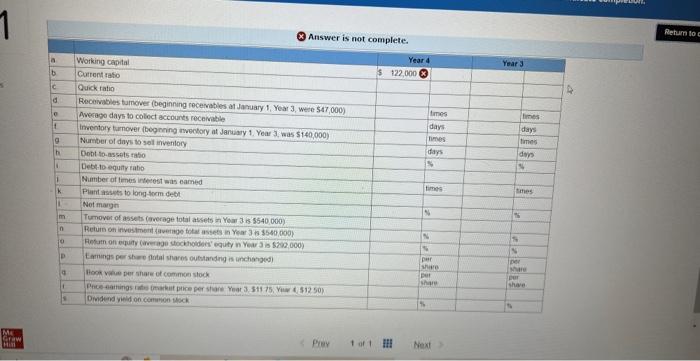

Required Calculate the following ratios for Year 4 and Year 3 . o. Working capital. h. Curront tatin (Round vour answers to 2 decimal places.) Required Calculate the following ratios for Year 4 and Year 3. a. Working capital. b. Current ratio. (Round your answers to 2 decimal places.) c. Quick ratio. (Round your answers to 2 decimal places.) d. Recelvables turnover (beginning receivables at January 1, Year 3, were $47,000 ). (Round your answers to 2 decimal places.) e. Average days to collect accounts receivable, (Use 365 days in a year. Round your intermediate calculatlons to 2 decimal pinces and your final answers to the nearest whole number.) f. Inventory turnover (beginning inventory at January 1. Year 3, was $140,000 ). (Round your answers to 2 decimal piaces.) 9. Number of days to sell inventory. (Use 365 days in a year. Round your intermediate calculations to 2 decimal places and your find answers to the nearest whole number.) h. Debt-to-assets ratio. (Round your answers to the nearest whole percent.) 1. Debt-to-equity ratio. (Round your answers to 2 decimal places.) j. Number of times interest was earned. (Round your answers to 2 decimal places.) k. Plant assets to long-term debt. (Round your answers to 2 docimal places.) 1. Net margin. (Round your onswers to 2 decimal ploces.) m. Turnoyer of assets (average total assets in Year 3 is $540,000 ). (Round your answers to 2 decimal places.) n. Retim on investment (average total assets in Year 3 is $540.000. (Round your answers to 2 decimel places.) o. Return on equity (average stockholders" equity in Year 3 is $292.000 ). (Round your answers to 2 decimal places) p. Farnings per shire (total shares Outstanding is unchanged). (Round your answers to 2 decimal places.) q. Book value per share of common stock. (Round your answers to 2 decimal places.) r. Price. earnings fiatio (matket price per share: Yoar 3,51175 ; Year 4,$12.50 ) (Round your intermediate calculations and final enswer to 2 decimnl pleces.) 5. Dividend yield on common stock. (Round your answers to 2 decimal places.) Q. Answer is not complete. Pier 1 of 1 ift Next Required Calculate the following ratios for Year 4 and Year 3 . o. Working capital. h. Curront tatin (Round vour answers to 2 decimal places.) Required Calculate the following ratios for Year 4 and Year 3. a. Working capital. b. Current ratio. (Round your answers to 2 decimal places.) c. Quick ratio. (Round your answers to 2 decimal places.) d. Recelvables turnover (beginning receivables at January 1, Year 3, were $47,000 ). (Round your answers to 2 decimal places.) e. Average days to collect accounts receivable, (Use 365 days in a year. Round your intermediate calculatlons to 2 decimal pinces and your final answers to the nearest whole number.) f. Inventory turnover (beginning inventory at January 1. Year 3, was $140,000 ). (Round your answers to 2 decimal piaces.) 9. Number of days to sell inventory. (Use 365 days in a year. Round your intermediate calculations to 2 decimal places and your find answers to the nearest whole number.) h. Debt-to-assets ratio. (Round your answers to the nearest whole percent.) 1. Debt-to-equity ratio. (Round your answers to 2 decimal places.) j. Number of times interest was earned. (Round your answers to 2 decimal places.) k. Plant assets to long-term debt. (Round your answers to 2 docimal places.) 1. Net margin. (Round your onswers to 2 decimal ploces.) m. Turnoyer of assets (average total assets in Year 3 is $540,000 ). (Round your answers to 2 decimal places.) n. Retim on investment (average total assets in Year 3 is $540.000. (Round your answers to 2 decimel places.) o. Return on equity (average stockholders" equity in Year 3 is $292.000 ). (Round your answers to 2 decimal places) p. Farnings per shire (total shares Outstanding is unchanged). (Round your answers to 2 decimal places.) q. Book value per share of common stock. (Round your answers to 2 decimal places.) r. Price. earnings fiatio (matket price per share: Yoar 3,51175 ; Year 4,$12.50 ) (Round your intermediate calculations and final enswer to 2 decimnl pleces.) 5. Dividend yield on common stock. (Round your answers to 2 decimal places.) Q. Answer is not complete. Pier 1 of 1 ift Next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts