Question: please show work for each question 5. Mike Palm, CFA, is an analyst with a large money management firm. Currently, Palm is considering the risk

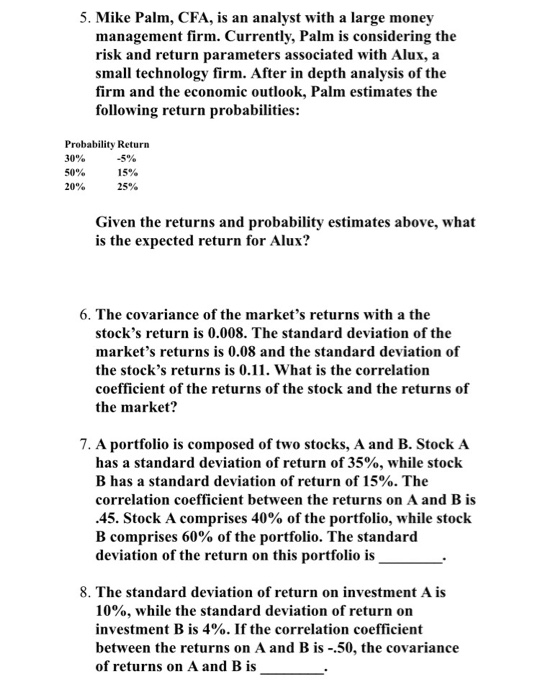

5. Mike Palm, CFA, is an analyst with a large money management firm. Currently, Palm is considering the risk and return parameters associated with Alux, a small technology firm. After in depth analysis of the firm and the economic outlook, Palm estimates the following return probabilities: Probability Return 30% 50% 15% 20% 25% Given the returns and probability estimates above, what is the expected return for Alux? 6. The covariance of the market's returns with a the stock's return is 0.008. The standard deviation of the market's returns is 0.08 and the standard deviation of the stock's returns is 0.11. What is the correlation coefficient of the returns of the stock and the returns of the market? 7. A portfolio is composed of two stocks, A and B. Stock A has a standard deviation of return of 35%, while stock B has a standard deviation of return of 15%. The correlation coefficient between the returns on A and B is .45. Stock A comprises 40% of the portfolio, while stock B comprises 60% of the portfolio. The standard deviation of the return on this portfolio is 8. The standard deviation of return on investment A is 10%, while the standard deviation of return on investment B is 4%. If the correlation coefficient between the returns on A and B is -50, the covariance of returns on A and B is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts