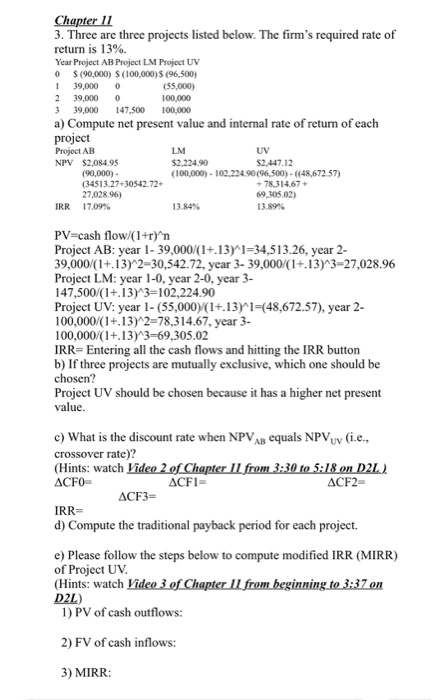

Question: Please show work, for part E! 1 3 Chapter 11 3. Three are three projects listed below. The firm's required rate of return is 13%.

1 3 Chapter 11 3. Three are three projects listed below. The firm's required rate of return is 13%. Year Project AB Project LM Project UV 0 $ 190,000) S (100,000) S (96,500) 39,000 0 (55,000) 2 39,0000 100.000 39,000 147,500 100,000 a) Compute net present value and internal rate of return of each project Project AB NPV $2,084.95 $2,224.90 52.447.12 (90,000) - (100,000) - 102.224.90(96,500) - (48,672 57) (34513.27-30542.72+ +78,314.67+ 27,028.96) 69,305.02) IRR 17.09% 13.84% 13.89% LM UV PV=cash flow/(1+r)^n Project AB: year 1- 39,000/(1+.13)1=34,513.26, year 2- 39,000/(1+.13)^2=30,542.72, year 3- 39,000/(1+.13)^3=27,028.96 Project LM: year 1-0, year 2-0, year 3- 147,500/(1+.13)^3=102,224.90 Project UV: year 1- (55,000/(1+.13)^2=(48,672.57), year 2- 100,000/(1+.13)^2=78,314.67, year 3- 100,000/(1+.13)3=69,305.02 IRR=Entering all the cash flows and hitting the IRR button b) If three projects are mutually exclusive, which one should be chosen? Project UV should be chosen because it has a higher net present value. c) What is the discount rate when NPVAB equals NPVUV (i.e., crossover rate)? (Hints: Watch Video 2 of Chapter 11 from 3:30 to 5:18 on D2L) ACFO ACFI= ACF2- ACF3= IRR= d) Compute the traditional payback period for each project. e) Please follow the steps below to compute modified IRR (MIRR) of Project UV. (Hints: Watch Video 3 of Chapter 11 from beginning to 3:37 on D2L) 1) PV of cash outflows: 2) FV of cash inflows: 3) MIRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts