Question: Please show work for the Duration question only using a HP 10b calculator The purchase price will be based upon a cap rate of 10.5%,

Please show work for the Duration question only using a HP 10b calculator

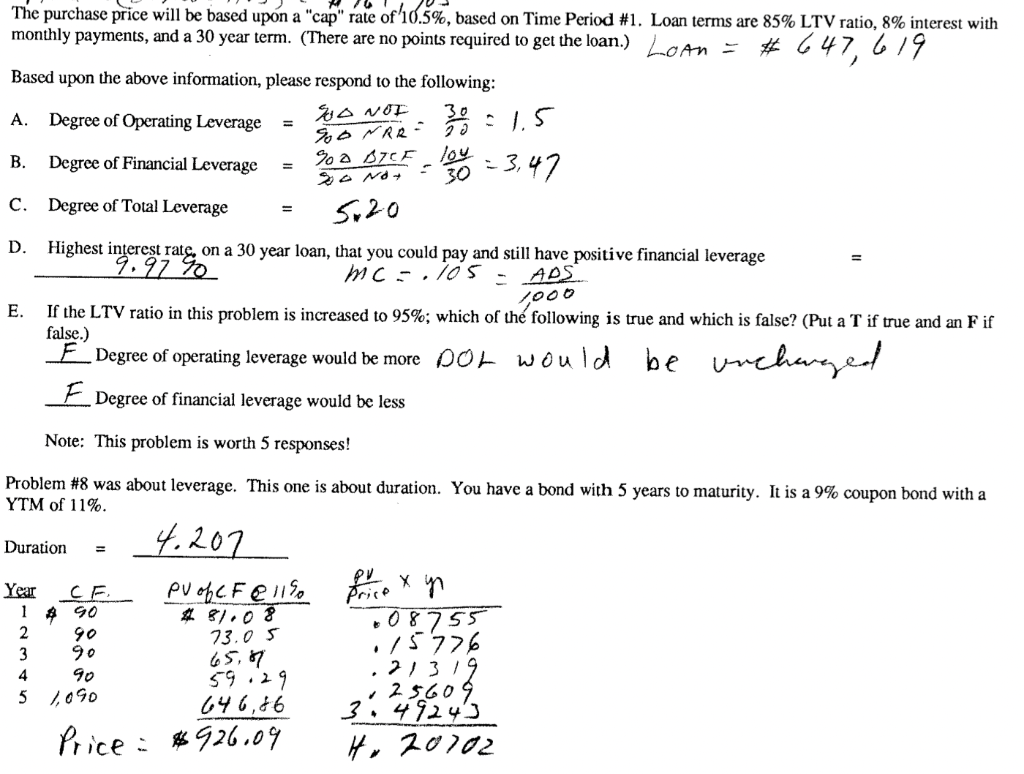

The purchase price will be based upon a "cap" rate of 10.5%, based on Time Period #1. Loan terms are 85% LTV ratio, 8% interest with monthly payments, and a 30 year term. (There are no points required to get the loan.) Loan #647, 619 Based upon the above information, please respond to the following: A. Degree of Operating Leverage LA NOT B. Degree of Financial Leverage % 0 A7CF Joy SANO C. Degree of Total Leverage 5.20 30 = 1.5 SORRES 3,47 D. Highest interest rate, on a 30 year loan, that you could pay and still have positive financial leverage 9.971 mc-.105 ADS 2000 E. If the LTV ratio in this problem is increased to 95%; which of the following is true and which is false? (Put a T if true and an F if false.) E Degree of operating leverage would be more pol would be unchanged F Degree of financial leverage would be less Note: This problem is worth 5 responses! Problem #8 was about leverage. This one is about duration. You have a bond with 5 years to maturity. It is a 9% coupon bond with a YTM of 11%. Duration _4.202 pu of CF e 11% Year CE 14 90 2 90 3 90 4 90 5 2,090 81.08 73.05 65,87 59.29 646,46 Price xy 08755 15776 ,21319 25609 3.49243 t. 20102 Price: $926.09

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts