Question: please show work for these questions 27. (0.3 point) A bond will pay $40 of interest at the end of each of the next five

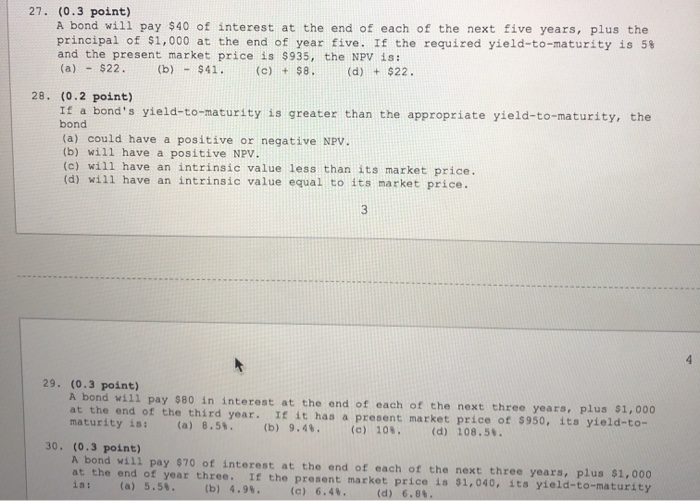

27. (0.3 point) A bond will pay $40 of interest at the end of each of the next five years, plus the principal of $1,000 at the end of year five. If the required yield-to-maturity is 5% and the present market price is $935, the NPV is: (a) - $22. (b) - $41. (c) + $8. (d) + $22. 28. (0.2 point) If a bond's yield-to-maturity is greater than the appropriate yield-to-maturity, the bond (a) could have a positive or negative NPV. (b) will have a positive NPV. (c) will have an intrinsic value less than its market price. (d) will have an intrinsic value equal to its market price. 3 4 29. (0.3 point) A bond will pay $80 in interest at the end of each of the next three years, plus $1,000 at the end of the third year. If it has a present market price of $950, its yield-to- maturity is: (a) 8.51. (b) 9.48. (c) 103. (d) 108.58. 30. (0.3 point) A bond will pay $70 of interest at the end of each of the next three years, plus $1,000 at the end of year three. If the present market price is $1,040, its yield-to-maturity 18: (a) 5.5. (b) 4.98. (c) 6.4. (d) 6.01

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts