Question: Please show work for thumbs up:) Assume a Schwab Small-Cap fund has an annual expected return of 18% and an annual standard deviation in returns

Please show work for thumbs up:)

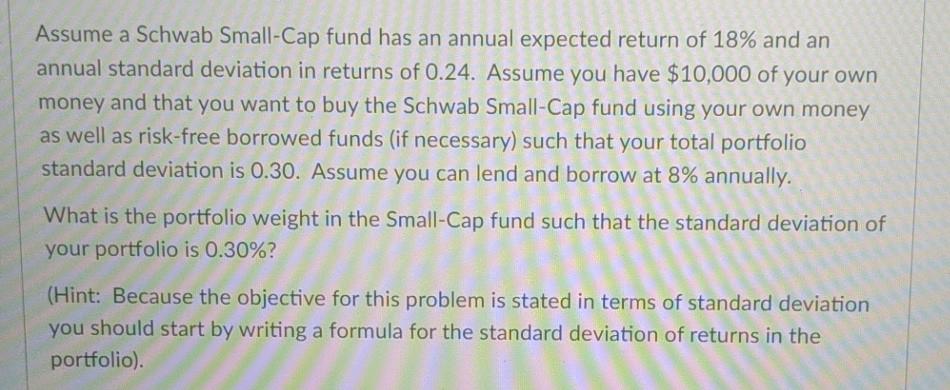

Assume a Schwab Small-Cap fund has an annual expected return of 18% and an annual standard deviation in returns of 0.24. Assume you have $10,000 of your own money and that you want to buy the Schwab Small-Cap fund using your own money as well as risk-free borrowed funds (if necessary) such that your total portfolio standard deviation is 0.30. Assume you can lend and borrow at 8% annually. What is the portfolio weight in the Small-Cap fund such that the standard deviation of your portfolio is 0.30%? (Hint: Because the objective for this problem is stated in terms of standard deviation you should start by writing a formula for the standard deviation of returns in the portfolio)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts