Question: Please show work I cant do it without the work. ABC, Inc has a before-tax cost of debt of 6.25% and a D/E ratio of

- Please show work I cant do it without the work.

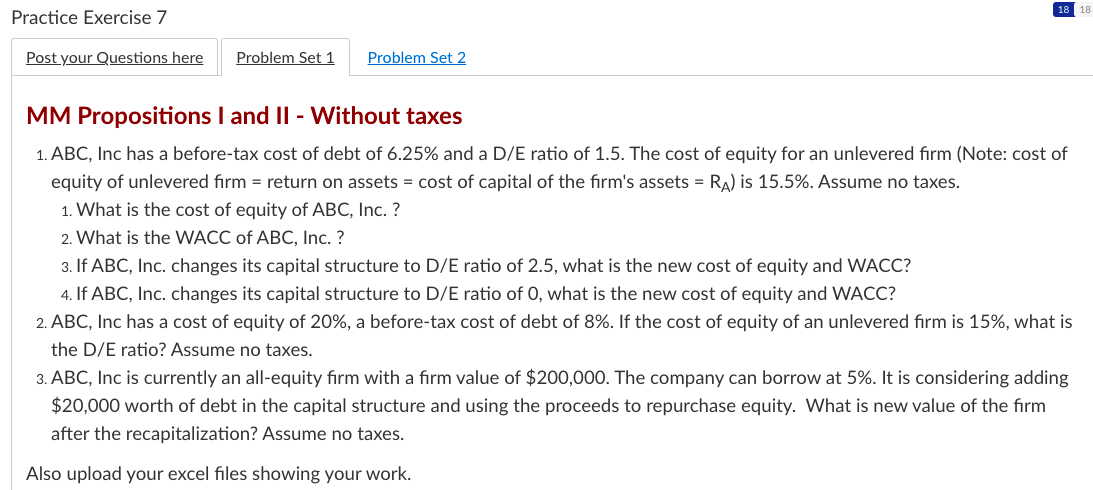

- ABC, Inc has a before-tax cost of debt of 6.25% and a D/E ratio of 1.5. The cost of equity for an unlevered firm (Note: cost of equity of unlevered firm = return on assets = cost of capital of the firm's assets = RA) is 15.5%. Assume no taxes.

- What is the cost of equity of ABC, Inc. ?

- What is the WACC of ABC, Inc. ?

- If ABC, Inc. changes its capital structure to D/E ratio of 2.5, what is the new cost of equity and WACC?

- If ABC, Inc. changes its capital structure to D/E ratio of 0, what is the new cost of equity and WACC?

- ABC, Inc has a cost of equity of 20%, a before-tax cost of debt of 8%. If the cost of equity of an unlevered firm is 15%, what is the D/E ratio? Assume no taxes.

- ABC, Inc is currently an all-equity firm with a firm value of $200,000. The company can borrow at 5%. It is considering adding $20,000 worth of debt in the capital structure and using the proceeds to repurchase equity. What is new value of the firm after the recapitalization? Assume no taxes

Practice Exercise 7 Post your Questions here Problem Set 1 Problem Set 2 MM Propositions I and II - Without taxes 1. ABC, Inc has a before-tax cost of debt of 6.25% and a D/E ratio of 1.5. The cost of equity for an unlevered firm (Note: cost of equity of unlevered firm = return on assets = cost of capital of the firm's assets = RA) is 15.5%. Assume no taxes. 1. What is the cost of equity of ABC, Inc. ? 2. What is the WACC of ABC, Inc. ? 3. If ABC, Inc. changes its capital structure to D/E ratio of 2.5, what is the new cost of equity and WACC? 4. If ABC, Inc. changes its capital structure to D/E ratio of O, what is the new cost of equity and WACC? 2. ABC, Inc has a cost of equity of 20%, a before-tax cost of debt of 8%. If the cost of equity of an unlevered firm is 15%, what is the D/E ratio? Assume no taxes. 3. ABC, Inc is currently an all-equity firm with a firm value of $200,000. The company can borrow at 5%. It is considering adding $20,000 worth of debt in the capital structure and using the proceeds to repurchase equity. What is new value of the firm after the recapitalization? Assume no taxes. Also upload your excel files showing your work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts