Question: please show work! please do questions A B C and D 1 ABC has a capital structure with debt at 60 % and equity at

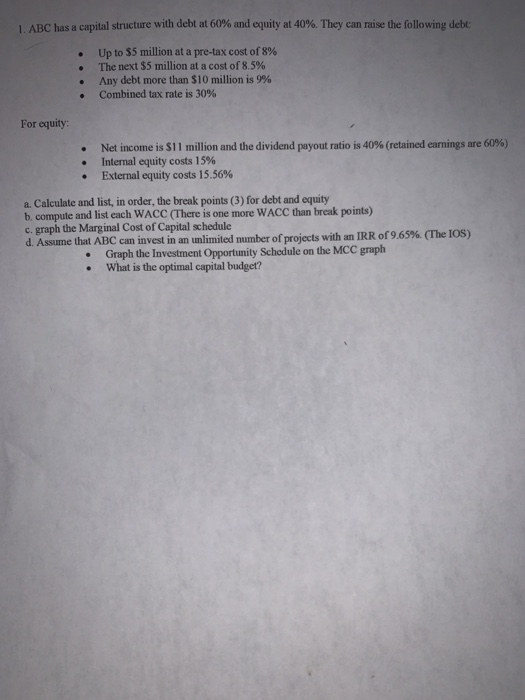

1 ABC has a capital structure with debt at 60 % and equity at 40%. They can raise the following debt Up to $5 million at a pre-tax cost of 8% The next $5 million at a cost of 8.5 % Any debt more than $10 million is 9% Combined tax rate is 30 % For equity: Net income is $1 1 million and the dividend payout ratio is 40 % ( retained earnings are 60 %) Internal equity costs 15 % External equity costs 15.56 % a. Calculate and list, in order, the break points (3) for debt and equity b. compute and list each WACC (There is one more WACC than break points) c. graph the Marginal Cost of Capital schedule d. Assume that ABC can invest in an unlimited number of projects with an IRR of 9.65 %. (The IOS) Graph the Investment Opportunity Schedule on the MCC graph what is the optimal capital budget? 1 ABC has a capital structure with debt at 60 % and equity at 40%. They can raise the following debt Up to $5 million at a pre-tax cost of 8% The next $5 million at a cost of 8.5 % Any debt more than $10 million is 9% Combined tax rate is 30 % For equity: Net income is $1 1 million and the dividend payout ratio is 40 % ( retained earnings are 60 %) Internal equity costs 15 % External equity costs 15.56 % a. Calculate and list, in order, the break points (3) for debt and equity b. compute and list each WACC (There is one more WACC than break points) c. graph the Marginal Cost of Capital schedule d. Assume that ABC can invest in an unlimited number of projects with an IRR of 9.65 %. (The IOS) Graph the Investment Opportunity Schedule on the MCC graph what is the optimal capital budget

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts