Question: Please show work. I need to learn. Thank you. I 9:15 PM T-Mobile Wi-Fi 57%-. CHAPTER 10 Debt investments not held to maturity are reported

Please show work. I need to learn. Thank you.

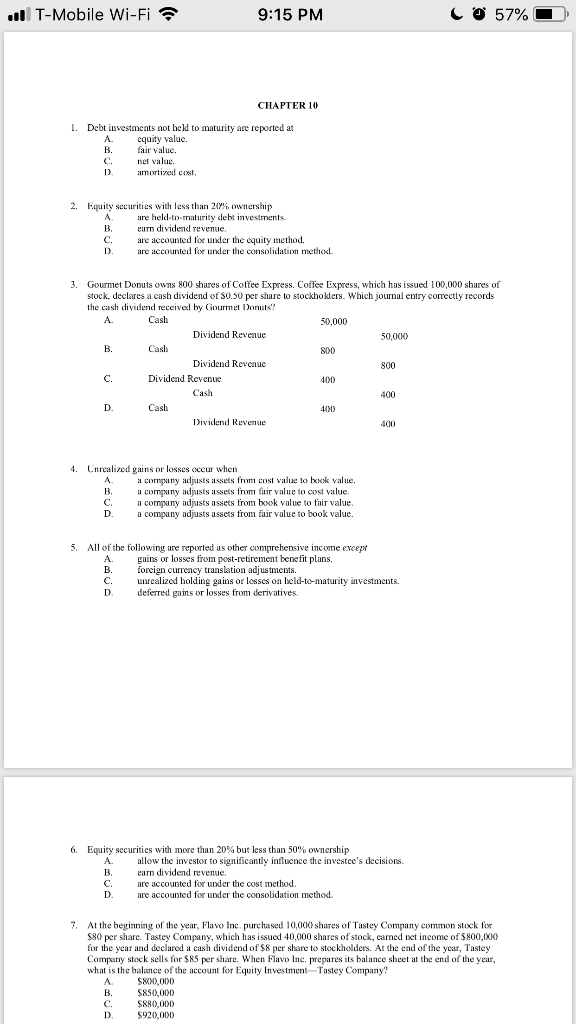

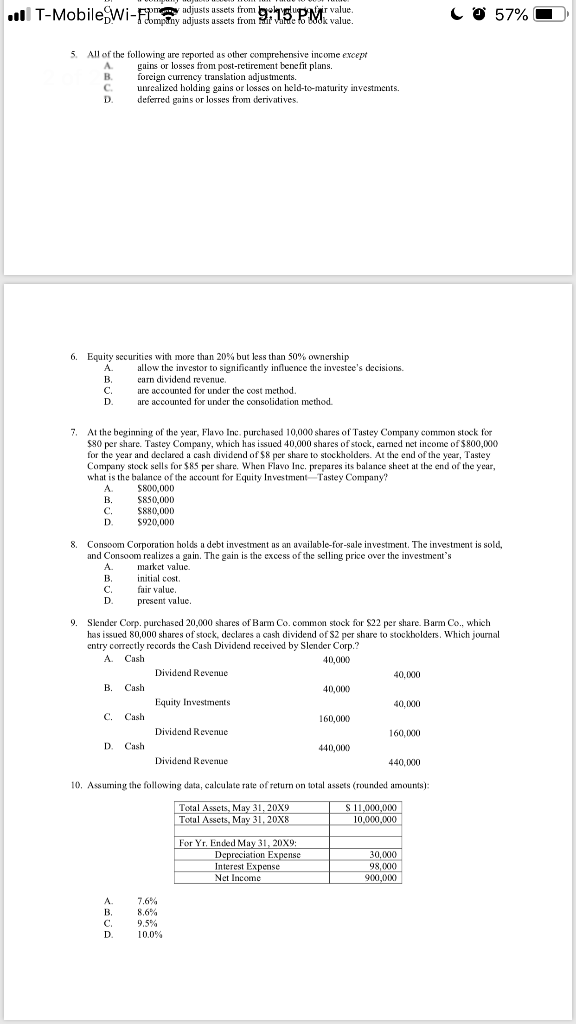

I 9:15 PM T-Mobile Wi-Fi 57%-. CHAPTER 10 Debt investments not held to maturity are reported at A. B. equity valuc. fair value. net value. amortined cost, 2. Equity securities with less than 20% ownership are held-to-maturity debt investments. earn dividend revenue are accounted foe under the equity method. A. C. are accounted for under the consolidation method 3. Gourmet Donuts owns 800 shares of Coffee Express. Coffee Express, which has issued 100,000 shares of stock declares a cash dividend of S0.50 per share to stockhokders. Which journal entry comectly records the cash dividend received by Ciourme? A. Dividend Revenue B. 800 Dividend Revenue Dividend Revenue D. Dividend Revenue 4. Unrealized gains or losses oecur when A company adjusts assets from cost alue to book value. a compuny adjusts assets from fair value to cost value. C company adjusts assets from book value to fair value D.a company adjusts assets from fair value to book value. 5. All of the following ure reported as other comprehensive incme except A. gains or losses from post-retirement benefit plans. B.foreign currency translation adjustments. C nrealized holding gains or losses on eld-to-maturity investments. D deferred gains or losses from derivatives. 6. Equity securities with more than 20% but less than 50% ownership A. alow the investor to significantly influence the investee's decisions. earn dividend revenue. are accounted for under the cost method D. are accounted for under the consolidation mcthod 7. At the beginning of the year, Flavo Inc. purchased 10,000 shares of Tastey Company common stock for $80 per share. Tastey Company, which has issued 40,000 shares of stock, camed net income of $800,000 for the year and declared a cash dividend of $8 per share to stockholders. At the end of the year, Tastey Company stl for $85 per share. When Flavo Inc. prepares its balance sheet at te end of the year what is the balance of the account for Equity Investment Tastey Company? A. B. S800,000 $850,000 $880,000 D. $920,000 adjusts assets from y adjusts assets from .l T-Mobili 57%-. 5. All of the following ure reported as other comprehensive incme except A. gins or losses from post-retirement benefit plans. B. foreign currency translation adjustments. C. unrealized holding gains or losses on eld-to-maturity investments. D. deferred gains or losses from derivatives. 6, Equity securities with more than 20% but less than 50% ownership A. alow the investor to significantly influence the investee's decisions. earn dividend revenue. are accounted for under the cost method D. are accounted for under the consolidation mcthod 7. At the beginning of the year, Flavo Inc purchased 10,000 shares of Tastey Company common stock for $80 per share. Tastey Company, which has issued 40,000 shares of stock, camed net income of $800,000 for the year and declared a cash dividend of $8 per share to stockholders. At the end of the year, Tastey Company stl for $85 per share. When Flavo Inc. prepares its balance sheet at te end of the year what is the balance of the account for Equity Investment Tastey Company? A. B. C. D. $920,000 $800,000 $850,000 $880,000 8. Consoom Corporation holds a debt investment as an available-for-sale investment. The investment is sold, and Consoom realizes a gain. The gain is the excess of the selling price over the investment's nitial cost fair value present value D. 9. Slender Corp. purchased 20,000 shares of Bam Co. common stock for S22 per share. Barm Co which has issued 80,000 shares of stock, declares a cash dividend of S2 per share to stockholders. Which journal entry correctly records the Cash Dividend received by Slender Corp.? A. Cash 40,000 Dividend Revenue 40,000 B. Caslh 40,000 Equity Investmemts 40,000 C. Cash 160,000 Dividend Revenue 160,000 D. Cash 440,000 Dividend Revenue 440,000 10. Assuming the following data, calculate rate of return on total assets (rounded amounts): s, May 31, 20X9 31.20X8 11,000,000 10,000,000 Total Assets. M For Yr. Ended May 31, 20X9: Depreciation Expense Interest Ex Net Income 30,000 98,000 900,000 A. B, 7.6% 8.6% 9,5% 10.0% D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts