Question: please show work i would like to know how to do this, thank you! also please explain how i calculate thr principle and interest oayments

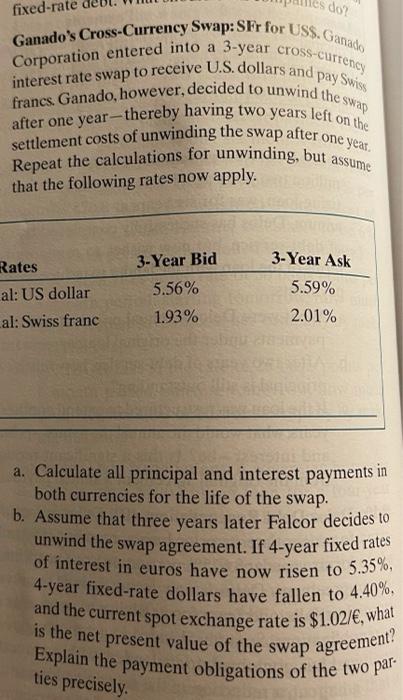

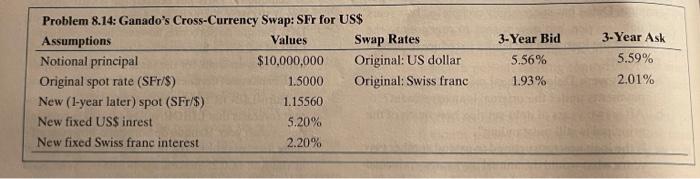

fixed-rate les dor 3-year cross-currency Corporation entered into a Ganado's Cross-Currency Swap: SFr for US$. Gavado interest rate swap to receive U.S. dollars and pay Swiss francs. Ganado, however, decided to unwind thes settlement costs of unwinding the swap after one year. Repeat the calculations for unwinding, but assume that the following rates now apply. after one year, thereby having two years left on the Rates al: US dollar al: Swiss franc 3-Year Bid 5.56% 1.93% 3-Year Ask 5.59% 2.01% a. Calculate all principal and interest payments in both currencies for the life of the swap. b. Assume that three years later Falcor decides to unwind the swap agreement. If 4-year fixed rates of interest in euros have now risen to 5.35%, 4-year fixed-rate dollars have fallen to 4.40%, and the current spot exchange rate is $1.02/, what is the net present value of the swap agreement? Explain the payment obligations of the two par ties precisely. Problem 8.14: Ganado's Cross-Currency Swap: SFr for US$ Assumptions Values Swap Rates Notional principal $10,000,000 Original: US dollar Original spot rate (SFr/$) 1.5000 Original: Swiss franc New (1-year later) spot (SFr/$) 1.15560 New fixed US$ inrest 5.20% New fixed Swiss franc interest 2.20% 3-Year Bid 5.56% 1.93% 3-Year Ask 5.59% 2.01% fixed-rate les dor 3-year cross-currency Corporation entered into a Ganado's Cross-Currency Swap: SFr for US$. Gavado interest rate swap to receive U.S. dollars and pay Swiss francs. Ganado, however, decided to unwind thes settlement costs of unwinding the swap after one year. Repeat the calculations for unwinding, but assume that the following rates now apply. after one year, thereby having two years left on the Rates al: US dollar al: Swiss franc 3-Year Bid 5.56% 1.93% 3-Year Ask 5.59% 2.01% a. Calculate all principal and interest payments in both currencies for the life of the swap. b. Assume that three years later Falcor decides to unwind the swap agreement. If 4-year fixed rates of interest in euros have now risen to 5.35%, 4-year fixed-rate dollars have fallen to 4.40%, and the current spot exchange rate is $1.02/, what is the net present value of the swap agreement? Explain the payment obligations of the two par ties precisely. Problem 8.14: Ganado's Cross-Currency Swap: SFr for US$ Assumptions Values Swap Rates Notional principal $10,000,000 Original: US dollar Original spot rate (SFr/$) 1.5000 Original: Swiss franc New (1-year later) spot (SFr/$) 1.15560 New fixed US$ inrest 5.20% New fixed Swiss franc interest 2.20% 3-Year Bid 5.56% 1.93% 3-Year Ask 5.59% 2.01%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts