Question: PLEASE SHOW WORK IF POSSIBLE Part 1: Part 2: (Risk and return) Your broker is offering an investment opportunity that she says will yield 150%

PLEASE SHOW WORK IF POSSIBLE

Part 1:

Part 2:

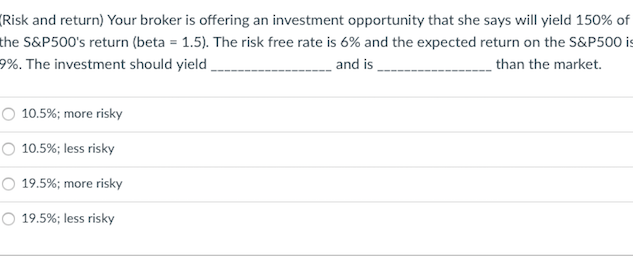

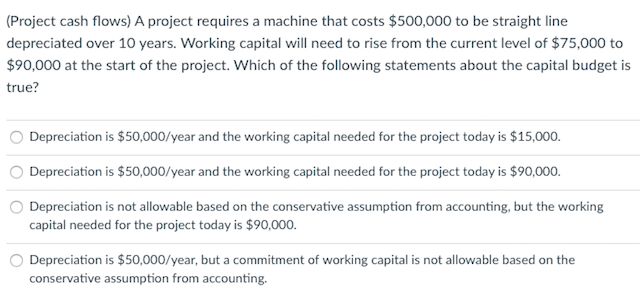

(Risk and return) Your broker is offering an investment opportunity that she says will yield 150% of the S&P500's return (beta = 1.5). The risk free rate is 6% and the expected return on the S&P500 is 9%. The investment should yield and is than the market. 10.5%; more risky 10.5%; less risky 19.5%; more risky 19.5%; less risky (Project cash flows) A project requires a machine that costs $500,000 to be straight line depreciated over 10 years. Working capital will need to rise from the current level of $75,000 to $90,000 at the start of the project. Which of the following statements about the capital budget is true? Depreciation is $50,000/year and the working capital needed for the project today is $15,000. Depreciation is $50,000/year and the working capital needed for the project today is $90,000. Depreciation is not allowable based on the conservative assumption from accounting, but the working capital needed for the project today is $90,000. Depreciation is $50,000/year, but a commitment of working capital is not allowable based on the conservative assumption from accounting

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts