Question: Please show work if possible Question 4 Mark A person buys a two-year annuity with a single premium on their 90th birthday. This individual will

Please show work if possible

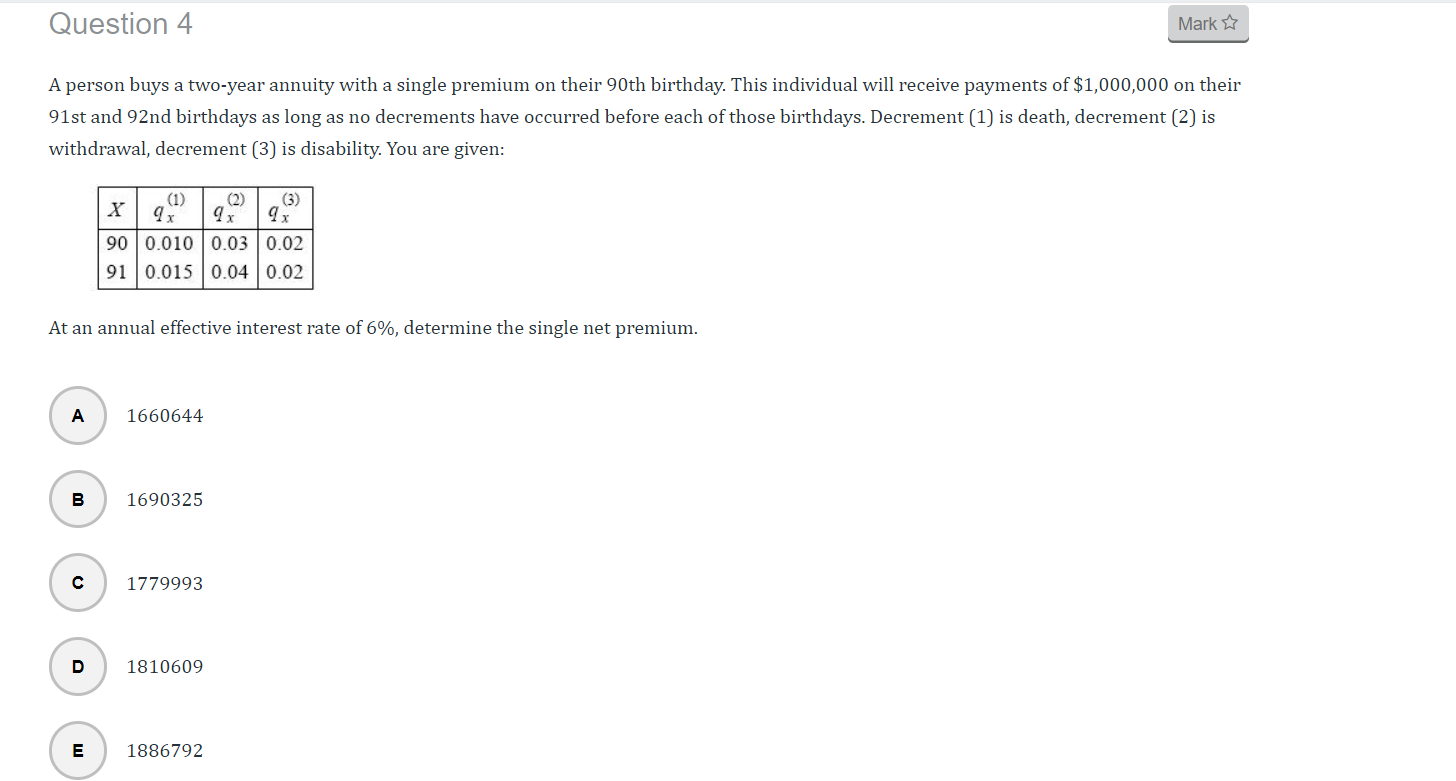

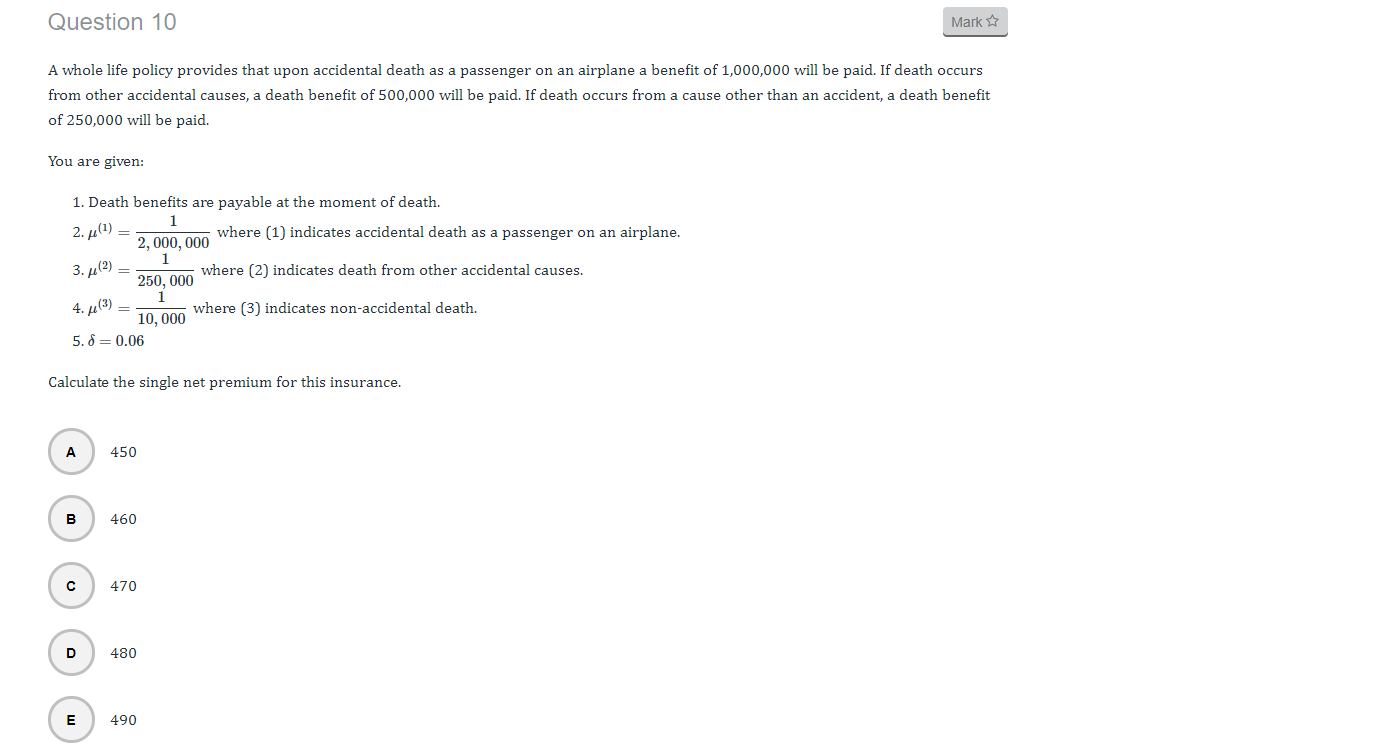

Question 4 Mark A person buys a two-year annuity with a single premium on their 90th birthday. This individual will receive payments of $1,000,000 on their 91st and 2nd birthdays as long as no decrements have occurred before each of those birthdays. Decrement (1) is death, decrement (2) is withdrawal, decrement (3) is disability. You are given: (1) (2) (3) 4 x 4x 90 0.010 0.03 0.02 91 0.015 0.04 0.02 At an annual effective interest rate of 6%, determine the single net premium. A 1660644 B 1690325 1779993 D 1810609 E 1886792 Question 10 Mark * A whole life policy provides that upon accidental death as a passenger on an airplane a benefit of 1,000,000 will be paid. If death occurs from other accidental causes, a death benefit of 500,000 will be paid. If death occurs from a cause other than an accident, a death benefit of 250,000 will be paid. You are given: 1. Death benefits are payable at the moment of death. 1 2. (1) where (1) indicates accidental death as a passenger on an airplane. 2,000,000 1 3.4(2) = where (2) indicates death from other accidental causes. 250,000 1 4.4(3) = where (3) indicates non-accidental death. 10,000 5.8=0.06 Calculate the single net premium for this insurance. A 450 B 460 470 D 480 E 490 Question 4 Mark A person buys a two-year annuity with a single premium on their 90th birthday. This individual will receive payments of $1,000,000 on their 91st and 2nd birthdays as long as no decrements have occurred before each of those birthdays. Decrement (1) is death, decrement (2) is withdrawal, decrement (3) is disability. You are given: (1) (2) (3) 4 x 4x 90 0.010 0.03 0.02 91 0.015 0.04 0.02 At an annual effective interest rate of 6%, determine the single net premium. A 1660644 B 1690325 1779993 D 1810609 E 1886792 Question 10 Mark * A whole life policy provides that upon accidental death as a passenger on an airplane a benefit of 1,000,000 will be paid. If death occurs from other accidental causes, a death benefit of 500,000 will be paid. If death occurs from a cause other than an accident, a death benefit of 250,000 will be paid. You are given: 1. Death benefits are payable at the moment of death. 1 2. (1) where (1) indicates accidental death as a passenger on an airplane. 2,000,000 1 3.4(2) = where (2) indicates death from other accidental causes. 250,000 1 4.4(3) = where (3) indicates non-accidental death. 10,000 5.8=0.06 Calculate the single net premium for this insurance. A 450 B 460 470 D 480 E 490

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts