Question: Please show work in Excel. 4. Ernest bought a US Treasury STRIPS bond on 7/1/2005 (settlement date). The bond was set to mature on 7/1/2035

Please show work in Excel.

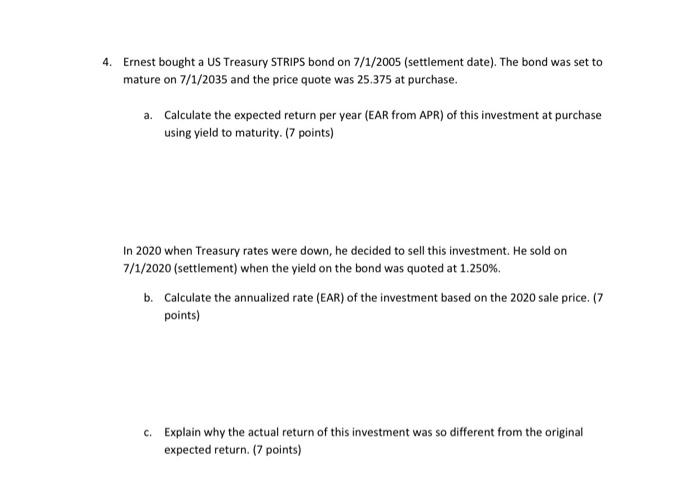

Please show work in Excel. 4. Ernest bought a US Treasury STRIPS bond on 7/1/2005 (settlement date). The bond was set to mature on 7/1/2035 and the price quote was 25.375 at purchase. a. Calculate the expected return per year (EAR from APR) of this investment at purchase using yield to maturity. (7 points) In 2020 when Treasury rates were down, he decided to sell this investment. He sold on 7/1/2020 (settlement) when the yield on the bond was quoted at 1.250%. b. Calculate the annualized rate (EAR) of the investment based on the 2020 sale price. (7 points) c. Explain why the actual return of this investment was so different from the original expected return. (7 points) 4. Ernest bought a US Treasury STRIPS bond on 7/1/2005 (settlement date). The bond was set to mature on 7/1/2035 and the price quote was 25.375 at purchase. a. Calculate the expected return per year (EAR from APR) of this investment at purchase using yield to maturity. (7 points) In 2020 when Treasury rates were down, he decided to sell this investment. He sold on 7/1/2020 (settlement) when the yield on the bond was quoted at 1.250%. b. Calculate the annualized rate (EAR) of the investment based on the 2020 sale price. (7 points) c. Explain why the actual return of this investment was so different from the original expected return. (7 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts