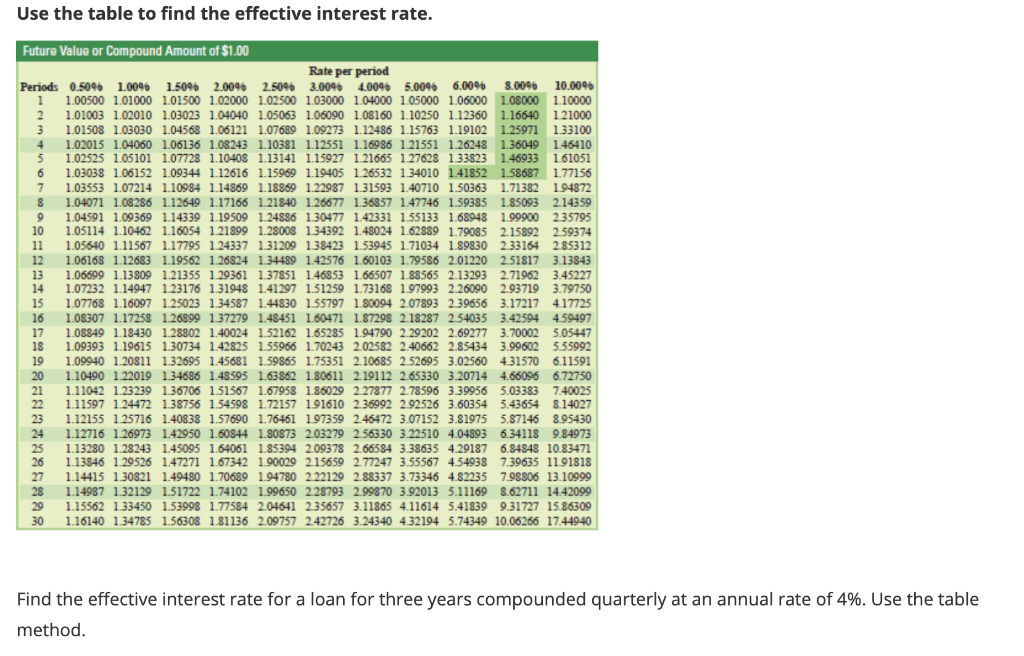

Question: Use the table to find the effective interest rate. Future Value or Compound Amount of $1.00 Rate per period Periods 0.50% 100% 1.50% 2.00% 2.5096

Use the table to find the effective interest rate. Future Value or Compound Amount of $1.00 Rate per period Periods 0.50% 100% 1.50% 2.00% 2.5096 3.0096 4.00% 5.0096 6.00% 8.0096 10.0096 1 1.00500 1.01000 1.01500 1.02000 1.02500 1.03000 1.04000 1.05000 1.06000 1.08000 1.10000 2 1.01003 1.02010 1.03023 1.04040 1.05063 1.06090 1.08160 1.10250 1.12360 1.16640 121000 3 1.01508 1.03030 1.04568 1.06121 1.07689 1.09273 1.12486 1.15763 1.19102 1.25971 133100 4 1.02015 1.04060 1.06136 1.08243 1.10381 1.12551 1.16986 1.21551 1.26248 1.36049 1.46410 5 1.02525 1.05101 1.07728 1.10408 1.13141 1.15927 1.21665 1.27628 1.33823 1.46933 1.61051 6 1.03038 1.06152 1.09344 1.12616 1.15969 1.19405 1.26532 1.34010 1.41852 1.58687 1.77156 7 1.03553 1.07214 1.10984 1.14869 1.18869 1.22987 1.31593 1.40710 1.50363 1.71382 194872 8 1.04071 1.08286 1.12649 1.17166 1.21840 1.26677 1.36857 1.47746 1.59385 1.85093 2.14359 9 1.04591 1.09369 1.14339 1.19509 1.24886 1.30477 1.42331 1.55133 1.68948 1.99900 235795 10 1.05114 1.10462 1.16054 1.21899 1.28008 1.34392 1.48024 1.62889 1.79085 2.15892 2.59374 11 1.05640 1.11567 1.17795 1.24337 1.31209 138423 1.53945 1.71034 1.89830 2.33164 2.85312 12 1.06168 1.12683 1.19562 1.26824 1.34489 1.42576 1.60103 1.79586 2.01220 2.51817 3.13843 13 1.06699 1.13809 1.21355 1.29361 1.37851 1.46853 1.66507 1.88565 2.13293 2.71962 3.45227 14 1.07232 1.14947 1.23176 131948 1.41297 1.51259 1.73168 197993 2.26090 2.93719 3.79750 15 1.07768 1.16097 1.25023 1.34587 1.44830 155797 1.80094 2.07893 2.39656 3.17217 4.17725 16 1.08307 1.17258 1.26899 137279 1.48451 1.60471 1.87298 2.18287 2.54035 3.42594 4.59497 17 1.08849 1.18430 1.28802 1.40024 1.52162 1.65285 1.94790 2 29202 2.69277 3.700025.05447 18 1.09393 1.19615 1.30734 1.42825 1.55966 1.70243 2.02582 2.40662 2.85434 3.99602 5.55992 19 1.09940 1.20811 1.32695 1.45681 1.59865 1.75351 2.10685 2.52695 3.02560 4.31570 6.11591 20 1.10490 1 22019 1.34686 1.48595 1.63862 1.80611 2.19112 2.65330 3.20714 4.66096 6.72750 21 1.11042 1 23239 1.36706 1.51567 1.67958 1.86029 2.27877 2.78596 3.39956 5.03383 7.40025 22 1.11597 1.24472 1.38756 154598 1.72157 191610 2.36992 2.92526 3.60354 5.43654 8.14027 23 1.12155 1.25716 1.40838 1.57690 1.76461 1.97359 2.46472 3.07152 3.81975 5.87146 8.95430 24 1.12716 1.26973 1.42950 1.60844 1.80873 2.03279 2.56330 3.22510 4.04893 6.34118 9.84973 25 1.13280 1.28243 1.45095 1.64061 1.85394 2.09378 2.66584 3.38635 4.29187 6.84848 10.83471 26 1.13846 1.29526 1.47271 1.67342 1.90029 2.15659 2.77247 3.55567 4.54938 7.39635 11.91818 27 1.14415 1.30821 1.49480 1.70689 1.94780 222129 2.88337 3.73346 4.82235 7.98806 13.10999 28 1.14987 132129 1.51722 1.74102 1.99650 2.28793 2.99870 3.92013 5.11169 8.62711 14.42099 29 1.15562 133450 1.53998 1.77584 2.04641 235657 3.11865 4.11614 5.41839 9.31727 15.86309 30 1.16140 1.34785 1.56308 1.81136 2.09757 2.42726 3.24340 4.32194 5.74349 10.06266 17.44940 Find the effective interest rate for a loan for three years compounded quarterly at an annual rate of 4%. Use the table method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts