Question: please show work in excel A company is considering a new 4-year expansion project that requires an investment of $200,000 for new equipment, plus an

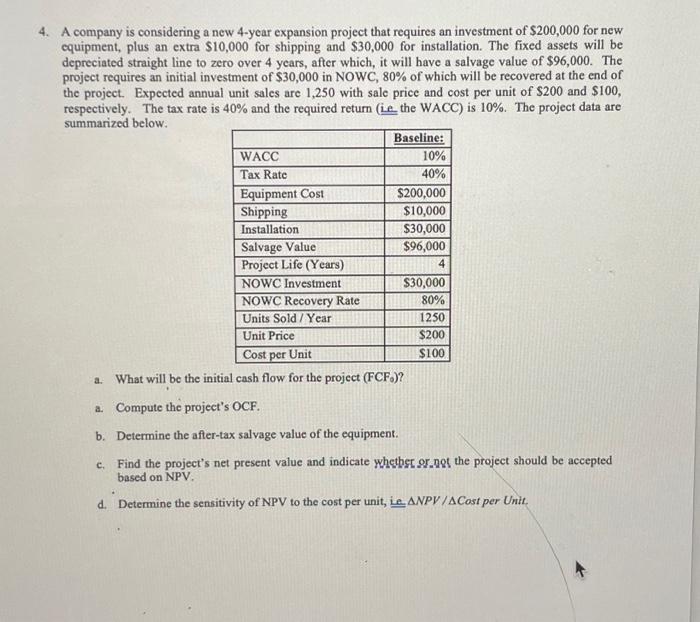

A company is considering a new 4-year expansion project that requires an investment of $200,000 for new equipment, plus an extra $10,000 for shipping and $30,000 for installation. The fixed assets will be depreciated straight line to zero over 4 years, after which, it will have a salvage value of $96,000. The project requires an initial investment of $30,000 in NOWC, 80% of which will be recovered at the end of the project. Expected annual unit sales are 1,250 with sale price and cost per unit of $200 and $100, respectively. The tax rate is 40% and the required return (Le the WACC) is 10%. The project data are summarized below. a. What will be the initial cash flow for the project ( FCF0) ? a. Compute the project's OCF. b. Determine the after-tax salvage value of the equipment. c. Find the project's net present value and indicate whether or.not the project should be accepted based on NPV. d. Determine the sensitivity of NPV to the cost per unit, ie. NPV/ Cost per Unit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts