Question: please show work in excel with formulas Consider the following project. The time-dependent projected 8-year annual annnuity of cash flows once the project begins is

please show work in excel with formulas

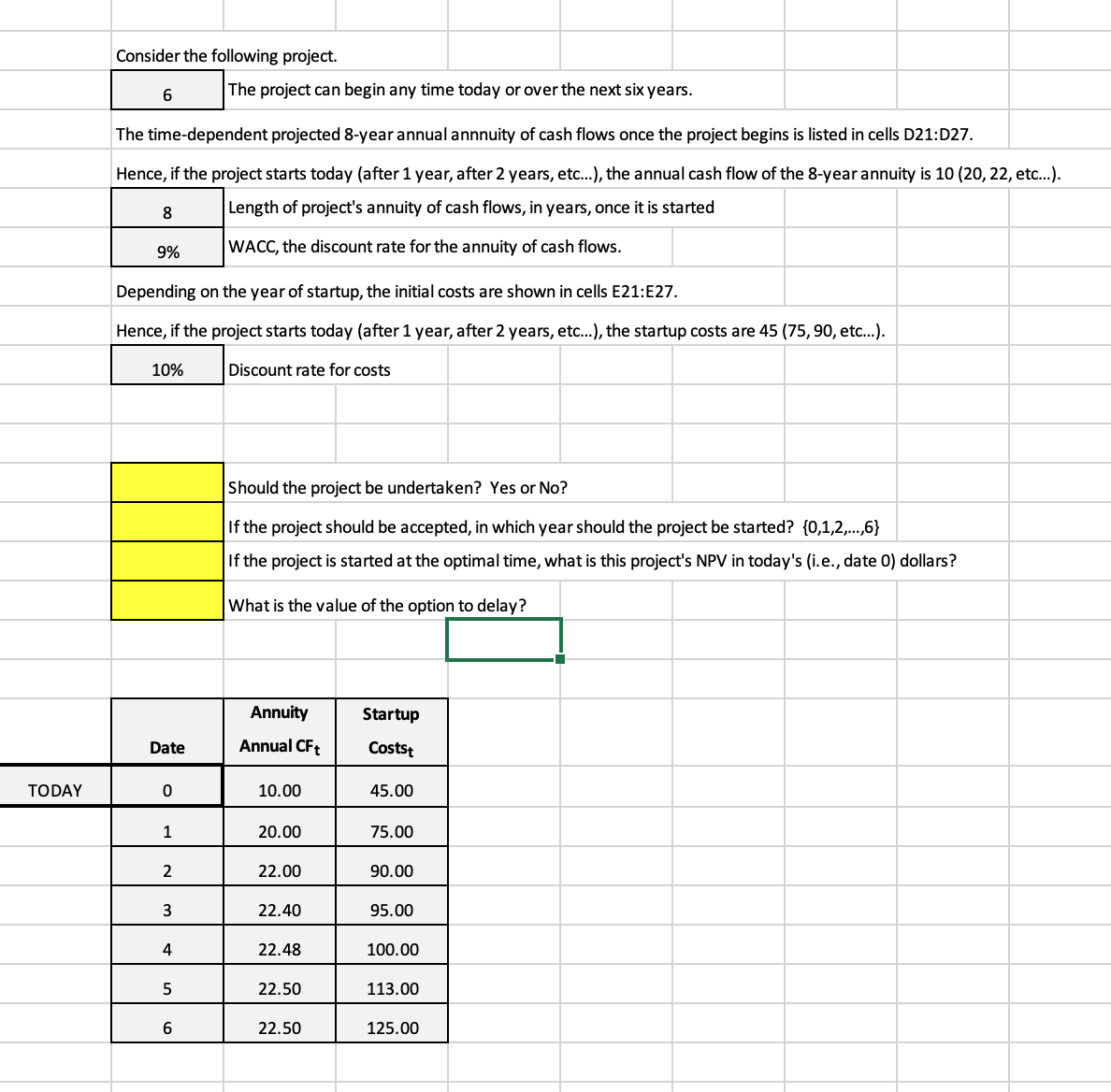

Consider the following project. The time-dependent projected 8-year annual annnuity of cash flows once the project begins is listed in cells D21:D27. Hence, if the project starts today (after 1 year, after 2 years, etc...), the annual cash flow of the 8-year annuity is 10 (20, 22, etc...). \begin{tabular}{|c|l|l|} \hline 8 & Length of project's annuity of cash flows, in years, once it is started \\ \hline 9% & WACC, the discount rate for the annuity of cash flows. \\ \hline \end{tabular} Depending on the year of startup, the initial costs are shown in cells E21:E27. Hence, if the project starts today (after 1 year, after 2 years, etc...), the startup costs are 45 (75, 90, etc...). 10% Should the project be undertaken? Yes or No? If the project should be accepted, in which year should the project be started? {0,1,2,,6} If the project is started at the optimal time, what is this project's NPV in today's (i.e., date 0 ) dollars? What is the value of the option to delay? \begin{tabular}{|c|c|c|c|} \cline { 2 - 4 } & Date & AnnuityAnnualCFt & StartupCostst \\ \hline TODAY & 0 & 10.00 & 45.00 \\ \hline & 1 & 20.00 & 75.00 \\ \hline & 2 & 22.00 & 90.00 \\ \hline 3 & 22.40 & 95.00 \\ \hline & 4 & 22.48 & 100.00 \\ \hline 5 & 22.50 & 113.00 \\ \hline & 6 & 22.50 & 125.00 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts