Question: Please show work on calculations 1. using financial leverage. All of the following are correct except: results in a fixed charge that may materially affect

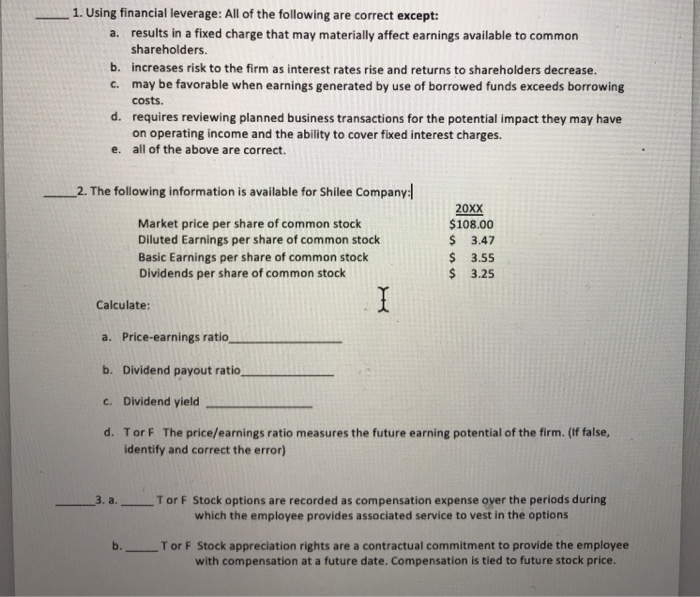

1. using financial leverage. All of the following are correct except: results in a fixed charge that may materially affect earnings available to common shareholders. increases risk to the firm as interest rates rise and returns to shareholders decrease. may be favorable when earnings generated by use of borrowed funds exceeds borrowing costs. requires reviewing planned business transactions for the potential impact they may have on operating income and the ability to cover fixed interest charges. all of the above are correct. a. b. c. d. e. -2. The following information is available for Shilee Company: 20XX $108.00 $3.47 Market price per share of common stock Diluted Earnings per share of common stock Basic Earnings per share of common stock Dividends per share of common stock 3.55 $3.25 Calculate a. Price-earnings ratio b. Dividend payout ratio c. Dividend yield d. TorF The price/earnings ratio measures the future earning potential of the firm. (If false, identify and correct the error) 3. a. Tor F Stock options are recorded as compensation expense over the periods during which the employee provides associated service to vest in the options b.---Tor F Stock appreciation rights are a contractual commitment to provide the employee with compensation at a future date. Compensation is tied to future stock price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts