Question: PLEASE SHOW WORK ON HOW TO GET TO GIVEN CORRECT ANSWER Robinson Industries has a defined benefit pension plan that specifies annual retirement benefits equal

PLEASE SHOW WORK ON HOW TO GET TO GIVEN CORRECT ANSWER

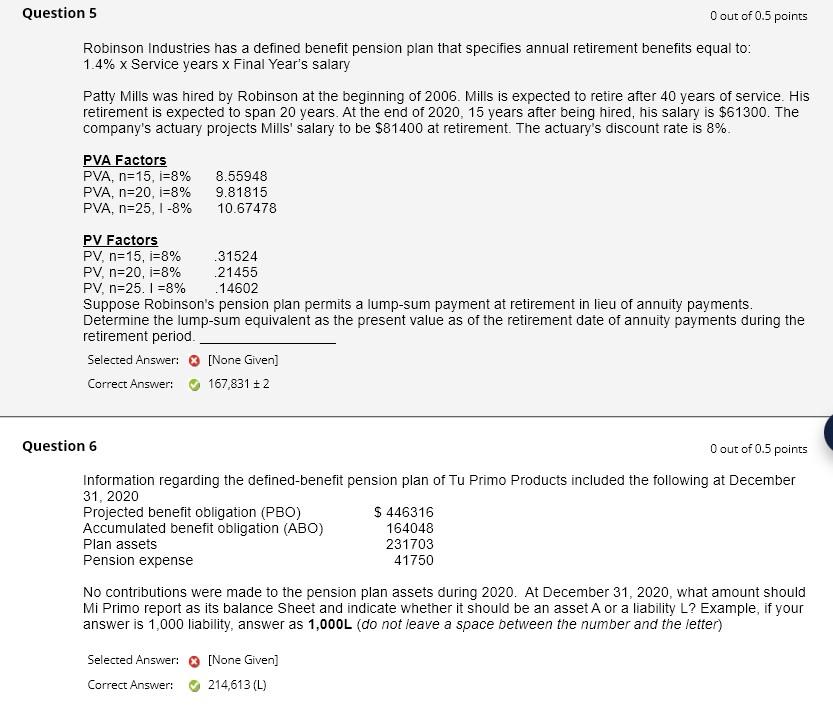

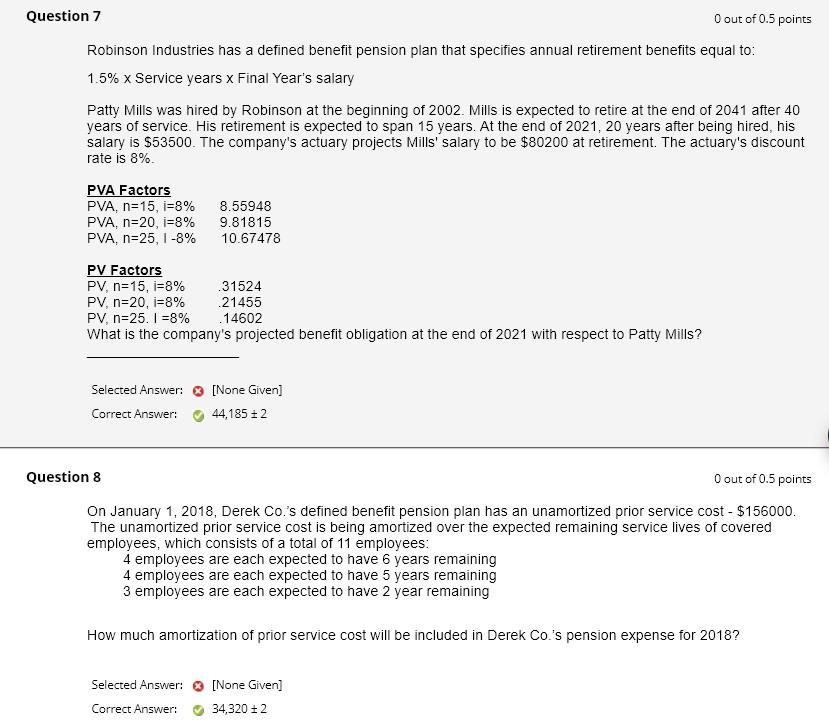

Robinson Industries has a defined benefit pension plan that specifies annual retirement benefits equal to: 1.4% Service years x Final Year's salary Patty Mills was hired by Robinson at the beginning of 2006 . Mills is expected to retire after 40 years of service. His retirement is expected to span 20 years. At the end of 2020,15 years after being hired, his salary is $61300. The company's actuary projects Mills' salary to be $81400 at retirement. The actuary's discount rate is 8%. Suppose Robinson's pension plan permits a lump-sum payment at retirement in lieu of annuity payments. Determine the lump-sum equivalent as the present value as of the retirement date of annuity payments during the retirement period. Selected Answer: [None Given] Correct Answer: 167,8312 tion 60 out of 0.5 points Information regarding the defined-benefit pension plan of Tu Primo Products included the following at December 312n2n No contributions were made to the pension plan assets during 2020 . At December 31,2020 , what amount should Mi Primo report as its balance Sheet and indicate whether it should be an asset A or a liability L? Example, if your answer is 1,000 liability, answer as 1,000L (do not leave a space between the number and the letter) Selected Answer: [None Given] Correct Answer: 214,613(L) Robinson Industries has a defined benefit pension plan that specifies annual retirement benefits equal to: 1.5% Service years x Final Year's salary Patty Mills was hired by Robinson at the beginning of 2002 . Mills is expected to retire at the end of 2041 after 40 years of service. His retirement is expected to span 15 years. At the end of 2021,20 years after being hired, his salary is $53500. The company's actuary projects Mills' salary to be $80200 at retirement. The actuary's discount rate is 8%. PVAFactorsPVA,n=15,i=8%PVA,n=20,i=8%PVA,n=25,I8%8.559489.8181510.67478 What is the company's projected benefit obligation at the end of 2021 with respect to Patty Mills? Selected Answer: [None Given] Correct Answer: 44,1852 ion 8 points 0.5 poins On January 1, 2018, Derek Co.'s defined benefit pension plan has an unamortized prior service cost $156000. The unamortized prior service cost is being amortized over the expected remaining service lives of covered employees, which consists of a total of 11 employees: 4 employees are each expected to have 6 years remaining 4 employees are each expected to have 5 years remaining 3 employees are each expected to have 2 year remaining How much amortization of prior service cost will be included in Derek Co.'s pension expense for 2018? Selected Answer: [None Given] Correct Answer: 34,3202

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts