Question: please show work on how you arrived at your answer C. You are looking at leasing a new computer versus buying it. Bull Gates gives

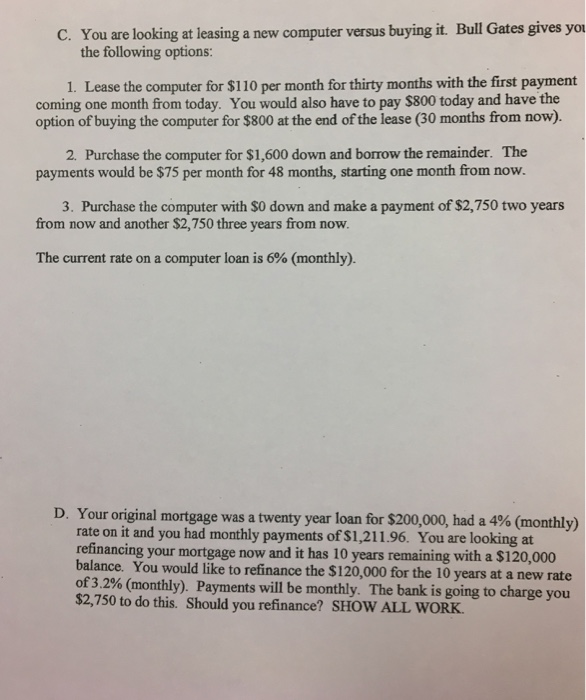

C. You are looking at leasing a new computer versus buying it. Bull Gates gives you the following options: 1. Lease the computer for $110 per month for thirty months with the first payment coming one month from today. You would also have to pay $800 today and have the option of buying the computer for $800 at the end of the lease (30 months from now). 2. Purchase the computer for $1,600 down and borrow the remainder. The payments would be $75 per month for 48 months, starting one month from now. 3. Purchase the computer with $0 down and make a payment of $2,750 two years from now and another $2,750 three years from now The current rate on a computer loan is 6% (monthly). D. Your original mortgage was a twenty year loan for $200,000, had a 4% (monthly) rate on it and you had monthly payments of $1,211.96. You are looking at refinancing your mortgage now and it has 10 years remaining with a $120,000 balance. You would like to refinance the $120,000 for the 10 years at a new rate of 3.2% (monthly) Payments will be monthly. The bank is going to charge you $2,750 to do this. Should you refinance? SHOW ALL WORK

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts