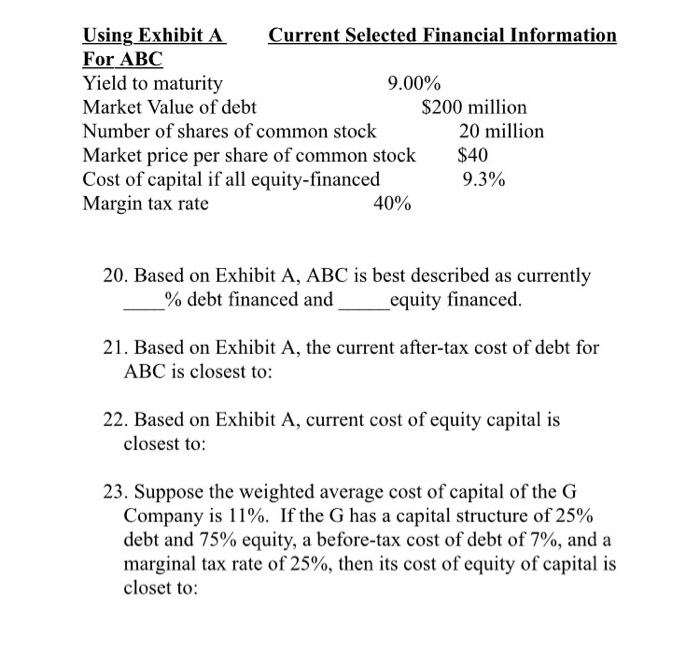

Question: please show work on how you got the answer thank you Using Exhibit A Current Selected Financial Information For ABC Yield to maturity 9.00% Market

Using Exhibit A Current Selected Financial Information For ABC Yield to maturity 9.00% Market Value of debt $200 million Number of shares of common stock 20 million Market price per share of common stock Cost of capital if all equity-financed 9.3% Margin tax rate 40% 20. Based on Exhibit A, ABC is best described as currently % debt financed and equity financed. 21. Based on Exhibit A, the current after-tax cost of debt for ABC is closest to: 22. Based on Exhibit A, current cost of equity capital is closest to: 23. Suppose the weighted average cost of capital of the G Company is 11%. If the G has a capital structure of 25% debt and 75% equity, a before-tax cost of debt of 7%, and a marginal tax rate of 25%, then its cost of equity of capital is closet to

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts