Question: Please show work on how you got the answer, thank you! 10. On February 1, Galva collects $60,000 for a job and credits Revenue. Galva's

Please show work on how you got the answer, thank you!

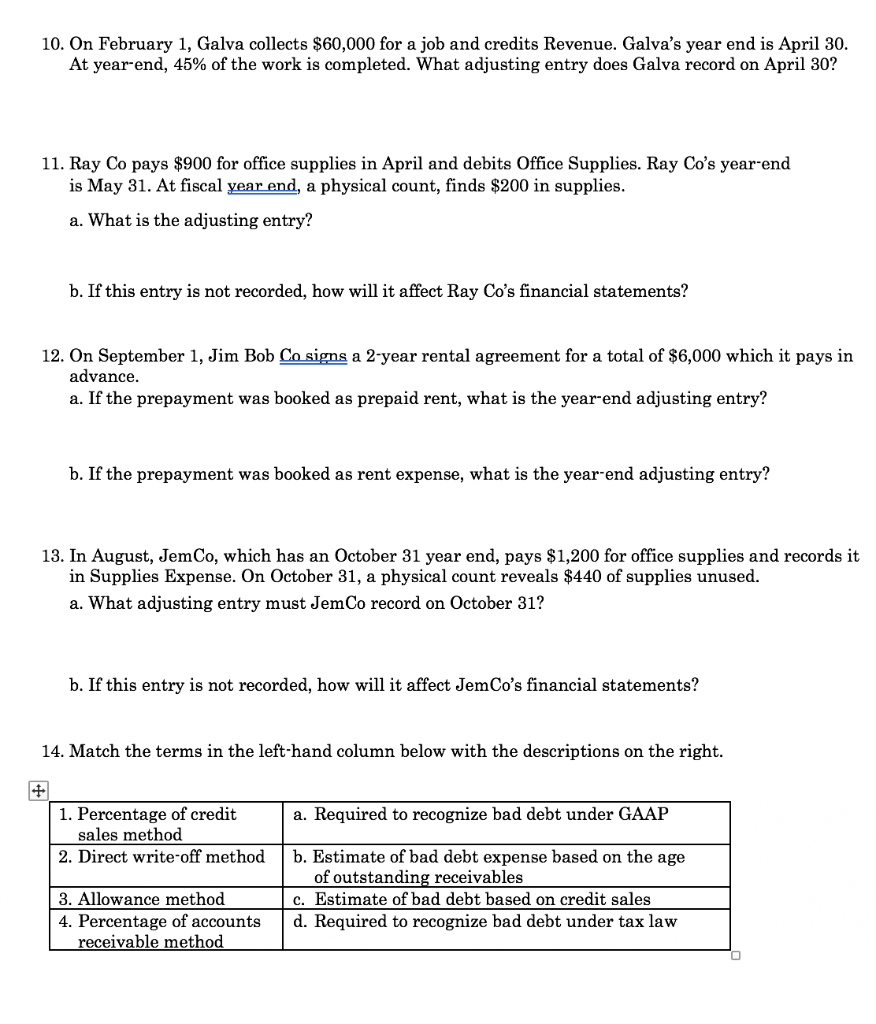

10. On February 1, Galva collects $60,000 for a job and credits Revenue. Galva's year end is April 30. At year-end, 45% of the work is completed. What adjusting entry does Galva record on April 30? 11. Ray Co pays $900 for office supplies in April and debits Office Supplies. Ray Co's year-end is May 31. At fiscal year end, a physical count, finds $200 in supplies. a. What is the adjusting entry? b. If this entry is not recorded, how will it affect Ray Co's financial statements? 12. On September 1, Jim Bob Co signs a 2-year rental agreement for a total of $6,000 which it pays in advance. a. If the prepayment was booked as prepaid rent, what is the year-end adjusting entry? b. If the prepayment was booked as rent expense, what is the year-end adjusting entry? 13. In August, Jem Co, which has an October 31 year end, pays $1,200 for office supplies and records it in Supplies Expense. On October 31, a physical count reveals $440 of supplies unused. a. What adjusting entry must JemCo record on October 31? b. If this entry is not recorded, how will it affect Jem Co's financial statements? 14. Match the terms in the left-hand column below with the descriptions on the right. a. Required to recognize bad debt under GAAP 1. Percentage of credit sales method 2. Direct write-off method b. Estimate of bad debt expense based on the age of outstanding receivables c. Estimate of bad debt based on credit sales d. Required to recognize bad debt under tax law 3. Allowance method 4. Percentage of accounts receivable method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts