Question: Please SHOW WORK Please show all work. Little if any credit will be given for answers without work. 1. A bond with a face value

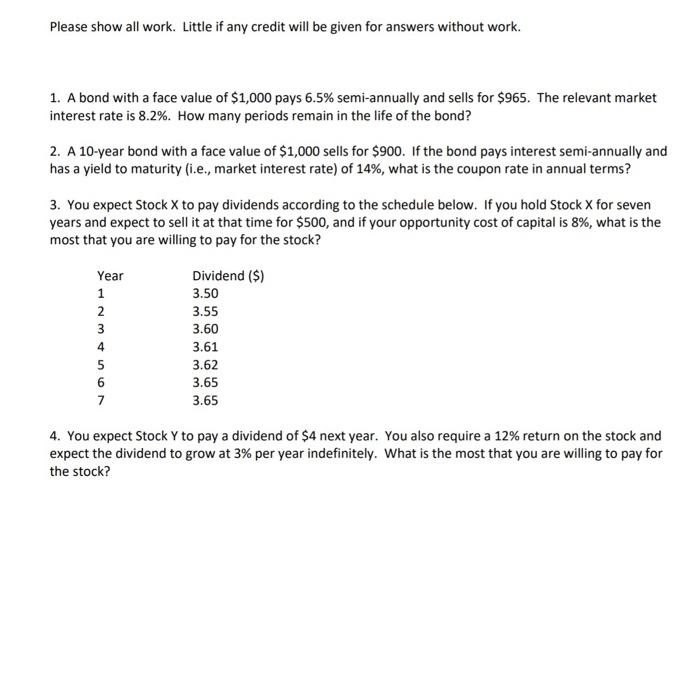

Please show all work. Little if any credit will be given for answers without work. 1. A bond with a face value of $1,000 pays 6.5% semi-annually and sells for $965. The relevant market interest rate is 8.2%. How many periods remain in the life of the bond? 2. A 10-year bond with a face value of $1,000 sells for $900. If the bond pays interest semi-annually and has a yield to maturity (i.e., market interest rate) of 14%, what is the coupon rate in annual terms? 3. You expect Stock X to pay dividends according to the schedule below. If you hold Stock X for seven years and expect to sell it at that time for $500, and if your opportunity cost of capital is 8%, what is the most that you are willing to pay for the stock? Year 1 2 3 4 5 6 7 Dividend ($) 3.50 3.55 3.60 3.61 3.62 3.65 3.65 4. You expect Stock Y to pay a dividend of $4 next year. You also require a 12% return on the stock and expect the dividend to grow at 3% per year indefinitely. What is the most that you are willing to pay for the stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts