Question: Please Show Work. Preferably in Excel #1. RamTech Inc. projects earnings of $3/share next year. The company plans on retaining all of those earnings to

Please Show Work. Preferably in Excel

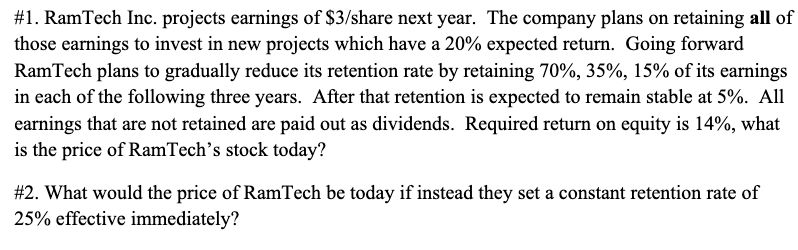

#1. RamTech Inc. projects earnings of $3/share next year. The company plans on retaining all of those earnings to invest in new projects which have a 20% expected return. Going forward RamTech plans to gradually reduce its retention rate by retaining 70%, 35%, 15% of its earnings in each of the following three years. After that retention is expected to remain stable at 5%. All earnings that are not retained are paid out as dividends. Required return on equity is 14%, what is the price of RamTech's stock today? #2. What would the price of RamTech be today if instead they set a constant retention rate of 25% effective immediately? #1. RamTech Inc. projects earnings of $3/share next year. The company plans on retaining all of those earnings to invest in new projects which have a 20% expected return. Going forward RamTech plans to gradually reduce its retention rate by retaining 70%, 35%, 15% of its earnings in each of the following three years. After that retention is expected to remain stable at 5%. All earnings that are not retained are paid out as dividends. Required return on equity is 14%, what is the price of RamTech's stock today? #2. What would the price of RamTech be today if instead they set a constant retention rate of 25% effective immediately

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts