Question: Please show work Problem #2: Jasper Metals is considering installing a new molding machine which is expected to produce annual pre-tax cost savings of $87,000

Please show work

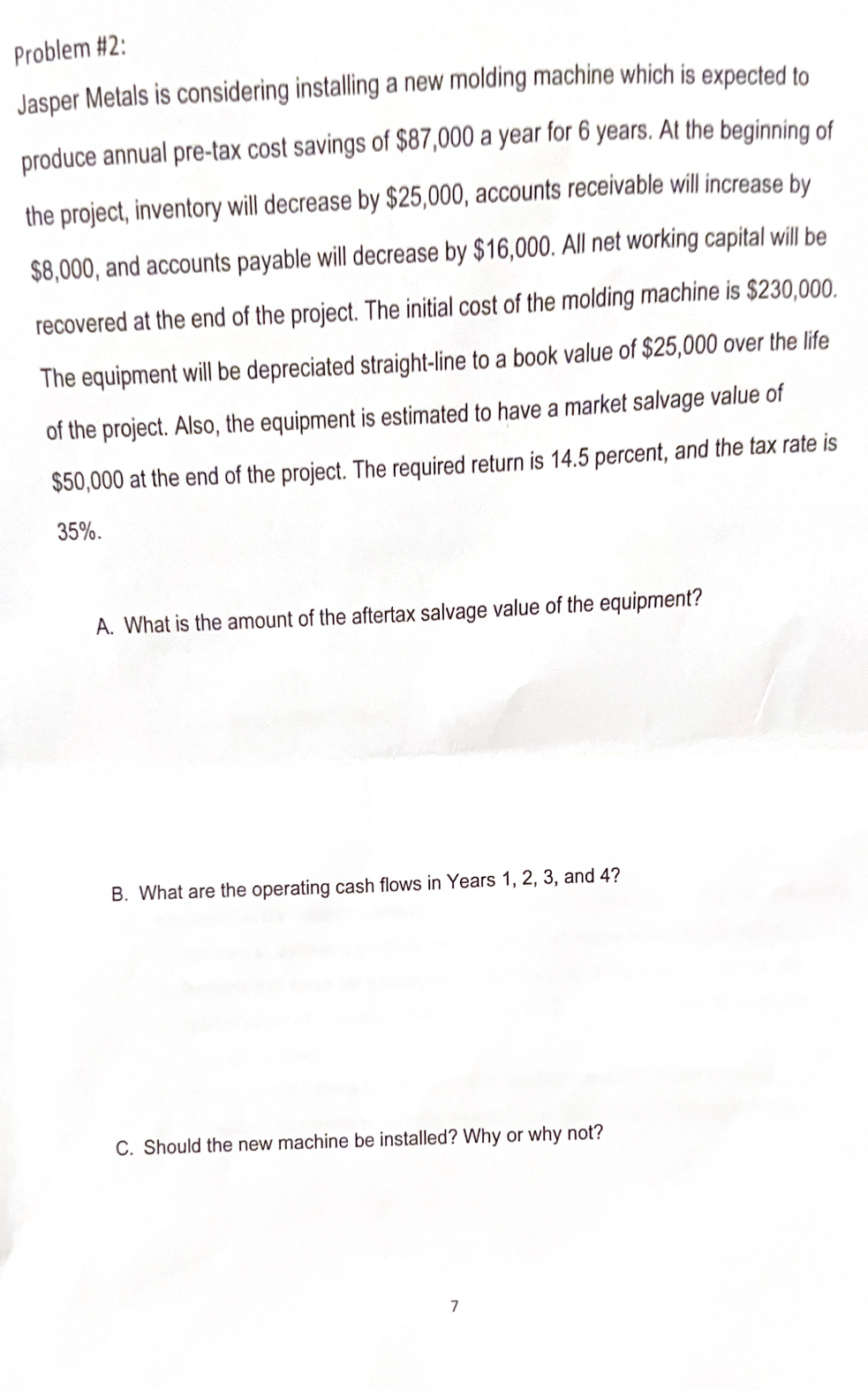

Problem \#2: Jasper Metals is considering installing a new molding machine which is expected to produce annual pre-tax cost savings of $87,000 a year for 6 years. At the beginning of the project, inventory will decrease by $25,000, accounts receivable will increase by $8,000, and accounts payable will decrease by $16,000. All net working capital will be recovered at the end of the project. The initial cost of the molding machine is $230,000. The equipment will be depreciated straight-line to a book value of $25,000 over the life of the project. Also, the equipment is estimated to have a market salvage value of $50,000 at the end of the project. The required return is 14.5 percent, and the tax rate is 35%. A. What is the amount of the aftertax salvage value of the equipment? B. What are the operating cash flows in Years 1, 2, 3, and 4 ? C. Should the new machine be installed? Why or why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts