Question: please show work Problem 3 (10 points) Chevy Corporation leases a building to Ford, Inc. on January 1, 2020. The following facts pertain to the

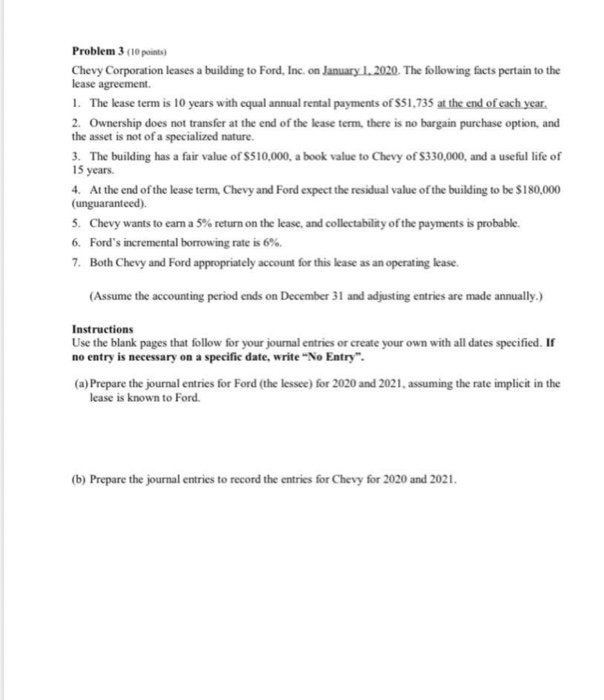

Problem 3 (10 points) Chevy Corporation leases a building to Ford, Inc. on January 1, 2020. The following facts pertain to the lease agreement. 1. The lease term is 10 years with equal annual rental payments of S51,735 at the end of each year. 2. Ownership does not transfer at the end of the lease term, there is no bargain purchase option, and the asset is not of a specialized nature. 3. The building has a fair value of $510,000, a book value to Chevy of $330,000, and a useful life of 15 years. 4. At the end of the lease term, Chevy and Ford expect the residual value of the building to be $180,000 (unguaranteed). 5. Chevy wants to earn a 5% return on the lease, and collectability of the payments is probable. 6. Ford's incremental borrowing rate is 6%. 7. Both Chevy and Ford appropriately account for this lease as an operating lease. (Assume the accounting period ends on December 31 and adjusting entries are made annually.) Instructions Use the blank pages that follow for your journal entries or create your own with all dates specified. If no entry is necessary on a specific date, write "No Entry". (a) Prepare the journal entries for Ford (the lessee) for 2020 and 2021, assuming the rate implicit in the lease is known to Ford. (b) Prepare the journal entries to record the entries for Chevy for 2020 and 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts