Question: Please Show Work Question 14 0 / 4 pts On 01-01-18, Barb issued $5,000,000 of 6%, 10-year term bonds. The bonds pay interest every July

Please Show Work

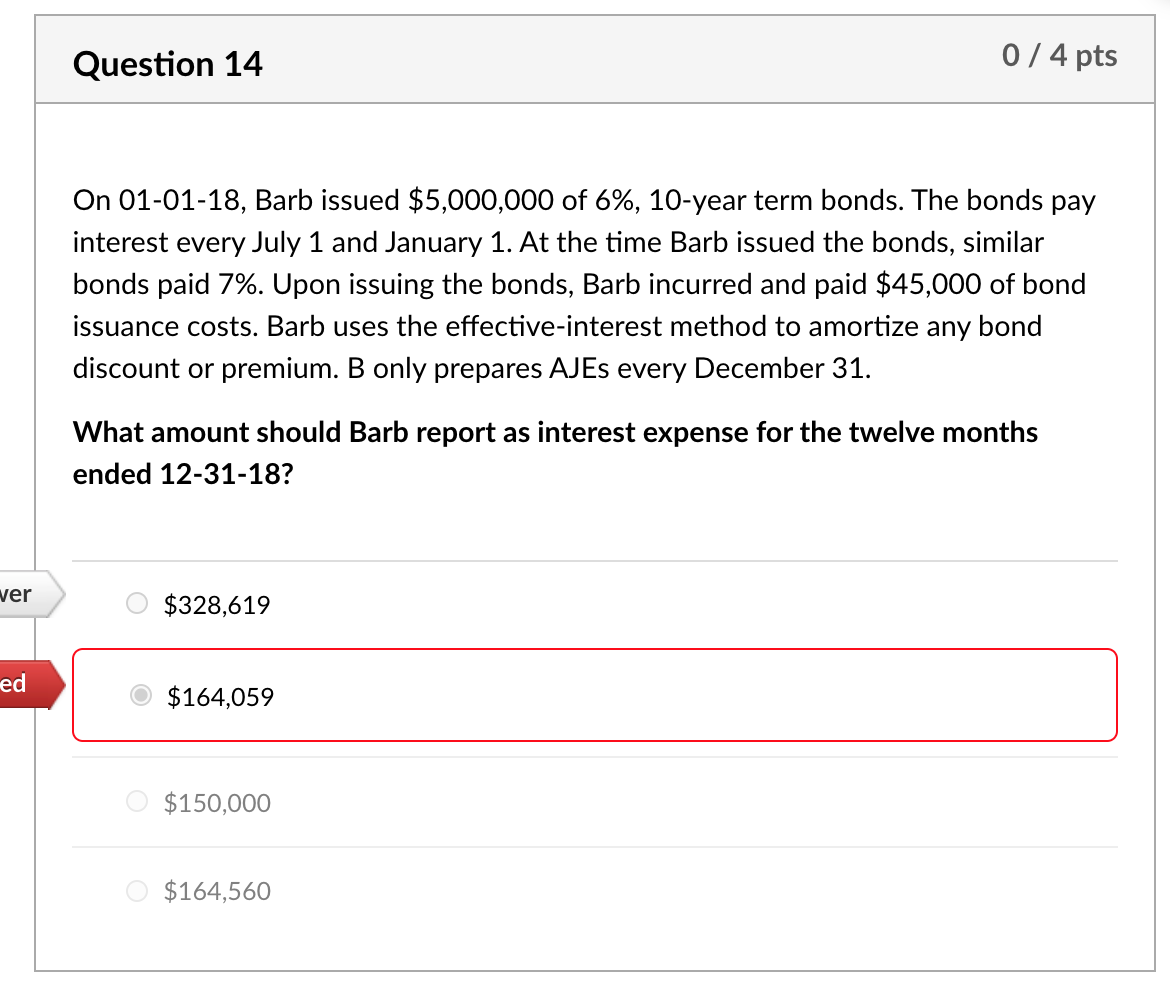

Question 14 0 / 4 pts On 01-01-18, Barb issued $5,000,000 of 6%, 10-year term bonds. The bonds pay interest every July 1 and January 1. At the time Barb issued the bonds, similar bonds paid 7%. Upon issuing the bonds, Barb incurred and paid $45,000 of bond issuance costs. Barb uses the effective-interest method to amortize any bond discount or premium. B only prepares AJEs every December 31. What amount should Barb report as interest expense for the twelve months ended 12-31-18? ver $328,619 ed $164,059 $150,000 $164,560

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts