Question: please show work Question no. 2 Graham Manufacturing is a small manufacturer that uses machine-hours as its activity base for assigned overhead costs to jobs.

please show work

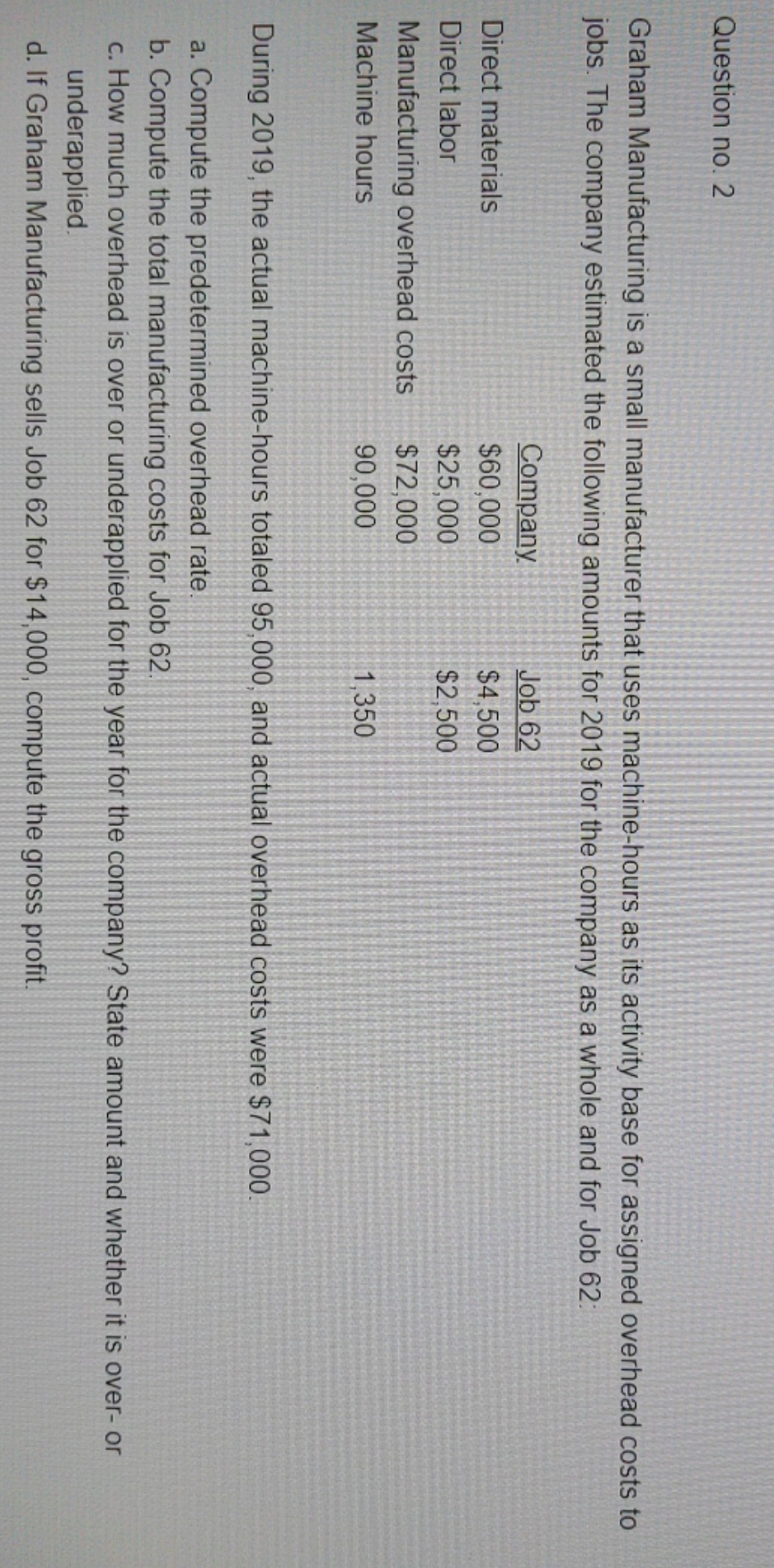

Question no. 2 Graham Manufacturing is a small manufacturer that uses machine-hours as its activity base for assigned overhead costs to jobs. The company estimated the following amounts for 2019 for the company as a whole and for Job 62: Company Job 62 Direct materials $60,000 $4.500 Direct labor $25,000 $2,500 Manufacturing overhead costs $72,000 Machine hours 90,000 1,350 During 2019, the actual machine-hours totaled 95,000, and actual overhead costs were $71,000 a. Compute the predetermined overhead rate b. Compute the total manufacturing costs for Job 62 c. How much overhead is over or underapplied for the year for the company? State amount and whether it is over- or underapplied d. If Graham Manufacturing sells Job 62 for $14,000, compute the gross profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts